China: an alternative to EU money for Hungary?

The Hungarian government is looking for an alternative to EU money and the relationship with China is continuous. This will not save the country, as it is only a fraction of the amount needed, but the cabinet is in constant contact with the Chinese.

Negotiations with the European Commission on the conditions for Hungary to receive money from the economic recovery fund after the Covid-19 pandemic are dragging on. As it is unclear whether the EU aid will arrive at all in time, Viktor Orbán indicated in his speech to parliament on Monday that his cabinet is looking for other sources. One possibility is to issue another Green Panda bond in China, according to an article by 24.hu.

Energy prices, which have risen seven to nine times in two to three years, generate huge expenditure, which worsens the current account. Compared to 2019, energy prices have gone through the roof by 2022: the energy bill in the current account has risen from HUF 570 billion to HUF 5059 (EUR 1.35 billion to 12 billion) billion for natural gas, from HUF 1008 billion to HUF 1479 billion (EUR 2.4 billion to 3.5 billion) for oil, and from HUF 201 billion to HUF 1556 billion (EUR 477 million to 3.7 billion) for electricity, Népszava writes.

EU funds could improve the situation, but for a long time this has been slow, and although the process has recently accelerated – as the Hungarian government has started to incorporate rules in line with EU rule of law requirements into the domestic legal order – the threat of money being withdrawn is still hanging over the country.

Government sources tell 24.hu that there is no talk of IMF involvement, but the cabinet is in constant contact with China and is preparing to issue a green Panda bond. This is also part of the public financing plan.

Hungary has already issued a similar Panda bond in 2021, which was priced at around HUF 50 billion (EUR 118.7 million) and subscribed by investors. As for the 2022 plans, the Public Debt Management Centre has announced that the foreign currency bond issuance limit has been increased by EUR 2.5 billion to EUR 5.1 billion. “This framework may include green Panda bond issuance as well as private placements in case of investor demand,” the body said.

Read alsoCabinet briefing: the Hungarian government announced new decisions

Source: 24.hu, Népszava

please make a donation here

Hot news

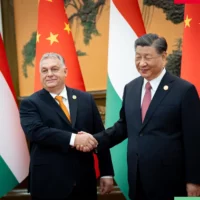

Chinese President to visit Budapest: why is Xi coming to Hungary?

Breaking: Hungarian government to sue Spar

Attention: Budapest-Vienna railway line renovation continues in Hungary, timetable changes

Orbán: Make America Great Again! Make Europe Great Again!

Hungary’s canine favourites: Exploring the top 5 beloved dog breeds

FM Szijjártó talks about Hungary-Azerbaijan friendship

6 Comments

Maybe the government wants to go back to selling citizenship’s to Chinese POS like in the past. Maybe even sell the country to China.

Imagine that LARGE building in Szabadsag ter – Budapest, Hungary – comments ‘Flying” around amongst those that occupy this “Place” – of Global POWER.

The China/Hungary – Line of Credit – and all “other” arrangements to-gether of their relationship/partnership – going back – EXISTING throughout the entirety of the x2 times, that Victor Orban / Fidesz Party – have Ruled – Hungary.

Budapest, Hungary – continues to be talked of the NEW – Silk Road.

The place of the EAST meeting with the West, then continuing its “VISIONS’ of Global expansion.

China/Hungary – will it HAPPEN – our “little ones” will have to have compulsory in their formulative Education curriculum, the learning of Mandarin ?

Those occupants in Szabadsag ter – the MIGHTY Power of their micro-scope 24×7 or 365 days a year – FOCUSED – on Hungary, the occupiers being a country Governed under DEMOCRACY – interesting – the “Talks” and knowledge of their opinions and position, relating to Hungary – its Financial “strangulation” – and No longer a DEMOCRACY.

Anything is better than the dictatorial EUSSR.

Sven, go spend some time in a Chinese concentration camp and see if you feel the same way. Look into China’s Social Credit System and you’ll never break a rule again. Your face and ID will be shown on the nearest electronic billboard so everyone can see how you are acting out of step. Hungary will also lose it’s place in NATO, because once that university is here and all Hungary’s state secrets are fed back to China each night, no decent country will befriend Hungary.

@János:

Hear, hear!

I’m sure “Sven” can’t even begin to imagine what it’s like for the Uyghurs (or any ethnic minority) in China.

@Cigány ország:

NOT related to your comment (nor to this article), but more to your nom de plume,

I have a recently found a long lost side of my family, a cousin (our great-grandfathers were brothers) in Argentina, and he is of the opinion that we Hungarians (ALL Hungarians) are “gitanos” (gypsies/cigányok).

He has that opinion because his grandfather said that to him, and his great-grandfather said that to my grand-uncle (my cousin’s grandfather).

My great-grand uncle was MAGYAR. Still makes me wonder why he emigrated to Argentina.

Whether my great-grand uncle was serious, or not, my cousin actually believes what he was told. Needless to say, my cousin and my siblings don’t communicate much with the Argentinian side of the family (anymore -except at Easter and Christmas).