The Japanese to brew Hungarian beer

According to mno.hu, the five biggest Hungarian beer producer companies fall under the interest of three European, one North American and a Far Eastern enterprise. They produce 6.54 hectolitre beer all together annually. The Japanese Asahi Group Holdings has confirmed recently that they were to buy the Belgian-Brazilian Anheuser-Busch InBev’s (AB InBev) five East European beer brands, including the Hungarian Dreher.

The enterprise also announced that they were to pay 900 billion yens, that is, more than 2300 billion forints for Dreher, the Czech Kozel and Pilsner Urquell, and the Polish Lech and Tyskie, all together. Asahi – which means “rising sun” in Japanese – had to make its plan public due to their shares decreasing by 4.6% on the Japanese stock market after the news of cornering, published in Nikkei business magazine.

According to Reuters’ information from early November, Mol Nyrt. also proposed an offer to buy the beer brands as part of the consortium. The partly state owned oil and gas industrial enterprise didn’t comment on why it would’ve acquired beer market interest arm-in-arm with the Polish Maspex Wadowice Group soda producer company and PZU insurance company.

The topic of selling arose after the global market leader AB InBev incorporated its biggest rival, the British-South African SABMiller disposing of Dreher’s marketing, for 96.2 billion dollars and then announced that it would get its Hungarian, Romanian, Czech, Slovakian and Polish interests off its hand. For that matter, the beer industrial mega-fusion meant the formation of a huge enterprise supervising 30.5% of the international beer market. Heineken (9.1%), the Danish Carlsberg (6.1%), the Hong Kong China Resources Enterprise (6%), the Chinese Tsingtao (4.7%) and the American-Canadian Molson Coors (3.2%) all lag behind.

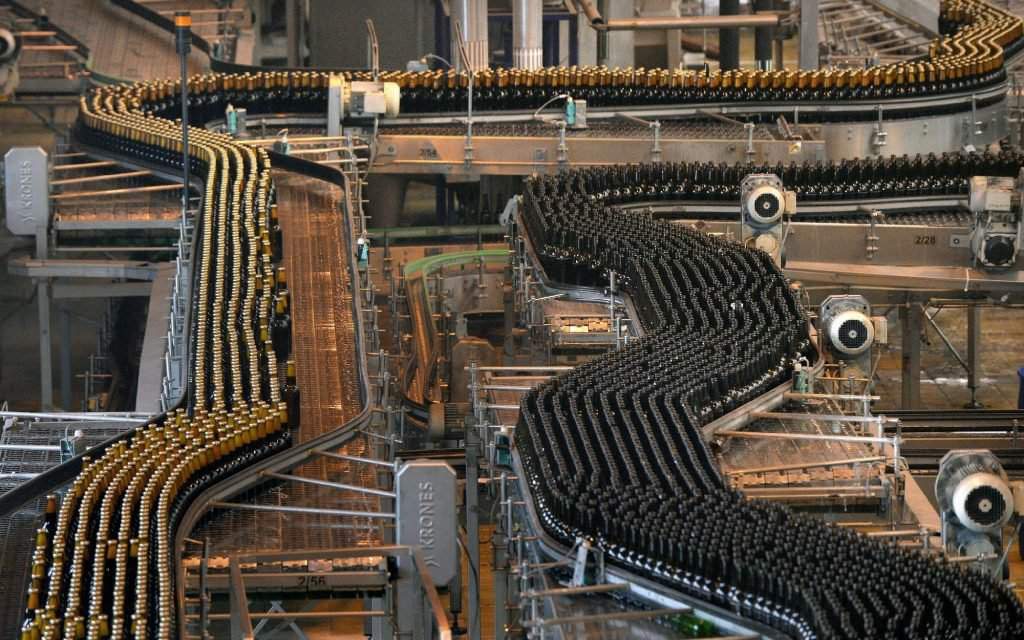

“It would be too early to comment on the agreement of AB InBev and Asahi, because it has to be approved by the European Commission. Until then, everything stays the same in the Dreher brewery” said Dreher. According to mno.hu’s resources with an insight into the inner operation of the company, the arrival of Japanese investors shouldn’t cause dramatic changes in the life of the Kőbánya centred factory. It seems like they can carry on focusing on their own tasks.

Market changes and rearrangements are typical in other industrial sectors as well. Hungarian beer-producers – as the members of big producer companies – don’t play an initiative role in how ownerships change. These types of decisions are made in company centres, on which Hungarian operation doesn’t have a direct influence. Since the buyer Asahi and the seller AB InBev are both stock market companies, even negotiations can be very delicate issues, not to mention the long process of the unification of local markets.

The figures of the Hungarian beer market are connected by the Association of Hungarian Brewers, which includes Dreher Breweries Inc., Heineken Hungária Breweries Inc., Borsodi Brewery Kft., Pécsi Brewery Inc., and Carlsberg Hungary Kft. provide information for annual reports. Borsodi used to be the property of AB InBev, but it belongs to Molson Coors since 2012. However, it kept its right of marketing Stella and Beck’s in Hungary.

The Dutch Heineken Group acquired the breweries of Sopron and Martfű in 2003, which incorporate the Soproni, Heineken, Gösser, Krusovice and Zlaty Bazant brands. The Danish Carlsberg took over Tuborg from Dreher in 2006 and acquired Kronenbourg in 2008, and Budweiser in 2010. The Pécsi Brewery is in Austrian hands, its parent company, the Ottakringer-Wenckheim Group, bought it in 1993.

According to the data of the Association of Hungarian Brewers, the amount of beer sold by Hungarian producers grew by 4%, to 6.54 million hectolitre, last year. Even though export decreased by 6% in 2015 and import increased by 26%, the rate of the latter still stayed under 10% compared to total marketing.

If we calculate the size of countries based on how many mugs of beer are drunk in a year, the Czech would dominate the world with their 144 litre/person rate. The silver medallist would be the Seychelles, not really known for its beer culture, while the third would be Germany. Hungary would come in the 31st place with 59 litre/person, which is a fallback compared to 2005’s 72 litres. It seems like we think of ourselves as a beer-consuming nation in vain, because countries like Panama, Congo and Namibia outdrink us. World powers would also cut a poor figure: the USA would be 17th, the UK 28th and India 58th. The average consumption is 30 litres in France, 29 litres in Italy and 13 litres in Turkey.

Photo: MTI

Copy editor: bm

Source: http://mno.hu/

please make a donation here

Hot news

Minister: Hungary will protect its territory by every means possible

Orbán cabinet may double airspace fee: another ticket price increase?

Hungary expanding the list of prohibited designer drugs

Hungarian minister: Ukraine ‘blackmailing’ Hungary and pro-peace states

Cocaine found on a Greek bus at southern border of Hungary

NCIS star arrived in Budapest: spin-off filming started