Central Bank’s new proposal to turn Hungarian property market upside-down?!

If the latest proposal of the Hungarian National Bank (MNB) is accepted, young adults in Hungary will be able to buy their first homes much more easily than before. This can bring significant changes in the Hungarian real estate market, including second-hand and new apartments, as well as property rentals.

The latest proposal of the Hungarian National Bank would like to support young people who would like to buy a home with lower self-sufficiency. Under current rules, young people have to pay a minimum of one-fifth, 20% of the property price to buy the ideal property out of a home loan.

However, according to the latest proposal of MNB, this limit would be reduced to 10% that would halve the current limit.

The acceptance of the proposal would be a great financial advantage for young adults who would be able to purchase their first home much more easily than before. In addition, they can also take advantage of the PIT (Personal Income Tax) exemption, the expected increase in wages, the involvement of parents as debtors or the use of state subsidies.

As a result, the new economic regulation can also significantly rearrange the Hungarian real estate market.

Besides stimulating the real estate market of second-hand and new apartments, it might have a remarkable impact on the rental market as well.

Firstly, it can reduce the demand for rental apartments if even more people decide to buy an own property. Secondly, it can increase the demand for studio apartments for sale as they represent the entry-level to the real estate market. According to László Balogh, senior financial expert of ingatlan.com, it would revive the market for first-home studio apartments, i.e. homes of 40m2 and less, which were otherwise among the most popular in recent years in terms of demand.

The price of second-hand apartments of this size varies from district to district. The lowest price category is registered in the 20th district (EUR 1654/m2), followed by the 14th district (EUR 2,198/m2). In the 6th, 7th, 11th and 13th districts, the price per square meter is between EUR 2,285-2,725. The most expensive districts are in the Buda Hills. The average prices per square meter in the 2nd and 12th districts are above EUR 2,734. In the case of new homes, we can find even higher prices per square meter with an average of EUR 2,790.

In large rural cities, the level of prices per square meter is much lower. In Győr, a second-hand home is offered for sale for EUR 1,969/m2, in Debrecen for EUR 1,742/m2, in Szeged for EUR 1,307/m2, in Pécs EUR 1,304/m2 and Miskolc for EUR 987/m2.

As the Hungarian news portal Pénzcentrum reports, based on average supply prices, a 35-40m2 second-hand apartment cost EUR 79,300-90,300.

Based on the proposal of MNB, even a tenth of this amount would be enough to apply for a housing loan, for which the monthly repayment of 20-year housing loans would be EUR 454-522.

This does not mean a final solution in all the cases, as the average net income of Hungarian young adults is EUR 667, most of whom cannot afford this amount of monthly repayment.

According to the financial expert, Hungarian young adults can take advantage of other state-subsidized solutions as well in order to purchase their first home. For couples planning to have children, for example, a baby-waiting loan is a good option, by which the monthly repayment can be reduced significantly. In the case of married couples, the credit burden is spread over several incomes. As well as some young adults can realise the purchase with the help of parents, either with direct support or as debtors for the loan. Accordingly, if the proposal comes into effect, it would halve the time it takes to raise a deductible if a young person set aside their full salary for this.

Read alsoHere are the biggest extremes in Budapest’s new property market!

Source: penzcentrum.hu

please make a donation here

Hot news

Will SPAR withdraw from Hungary? Find out the answer here!

Hungarian justice minister: Brussels does not focus on real problems

What happened today in Hungary? — 25 April, 2024

Azerbaijan supplies gas to Hungary for the first time in history

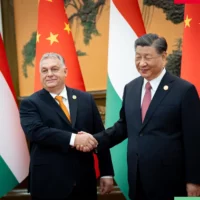

Chinese President to visit Budapest: why is Xi coming to Hungary?

Breaking: Hungarian government to sue Spar

6 Comments

If this proposal gets -APPROVED- and it contains and is moving in the Right direction of getting YOUNG first home buyers into the Property Market “giving” of Government – which they Rightfully should – it Must Not – ALLOW nor Permit any Foreign Investment – into this “forward thinking” scheme.

Applicants SHOULD need to present at time of application – a birth certificate that reads – place of birth – Hungary.

Loop holes and cracks – allowing Foreign Investment into this “creative” property investment scheme – need to be SEALED – that do not allow ANY form of Foreign Investment “bleeding” the citizens of Hungary – from there taxes – the Government funding support, being offered to the YOUNG – Hungarian People.

First Home Buyers Grants by Governments – are a forward thinking way of assisting getting the YOUNG into the property market – assisting them – making an INVESTMENT for there FUTURE.

SEAL it making property investment for the YOUNG – SOFTER – in Fianacial Deposit Terms – to secure a property – and – ERADICATE – any Foreign Investment participation into this – Hungarian by Birth only – Lending/Assisting Governmental Policy.

This proposed Policy from the Hungarian National Bank – is a “changing” idea and philosophy – in getting the YOUNG of Hungary by birth to invest into the Property Market.

It STILL has wide scope – to assist HUNGARIANS – by Birth – getting them into the INVESTMENT – that is Property.

Those READERS of DNH – supporters of getting the YOUNG – of Hungarian birth only, ensuring NO entry nor applications presented – no ” Masquerading ” – but of recognized Hungarian Birth & Registered – into Property Investment, should read the Government of Australia’s – Policy – under First Home Buyers Government Funding Scheme.

Australia – still a shortage of propertys for Buyers which is the reversal we face – growing – in Hungary of the Mass Surplus of Propertys on the Market for Sale – BUT – lacking buyer numbers and interest.

The wealth of Australia – of Australians – is firmly built around – Property – the ability to Secure/Purchase – Property, that is an Investment for there FUTURE.

Interesting comparison.

Hungarian Central Bank – and ALL – POLITICAL Parties in Hungary – include it – develope and EXPAND it – into your “core” Party Policies.

Who are the Future of Hungary ???

Why are we still seeing the YOUTH of Hungary – leaving there country of birth ?

Property – the making of it SIMPLER – Cheaper – for them – those Young of Hungarian Registered Birth and Education- this is – PARAMOUNT – going forward – that GOVERNMENT – should have as a HIGH Priority on there List – to Make it Happen.

The titles issued – legal documents prepared and Stamped/Sealed – in the Sale and Purchase – that PERTAIN – and are on the – Land & Soil – of Hungary – let them be STAMPED & Registered – that reflect those of Hungarian Birth – in greater number, and NOT of those from Foreign lands.

Congratulations Kitti, only five spelling/grammar mistakes in the first paragraph alone! Still some work to go to reach the depths of your native-speaking colleague Erdei János (AKA ‘John Woods’).

If the latest proposal of the Hungarian National Bank (MNB) IS accepted, young adults in Hungary WILL BE ABLE TO buy their first homeS much MORE EASILY than before. This can Affect significant changes in the Hungarian real estate market, including second-hand and new apartments, as well as property rentals.

Why don’t you employ a proofreader, or at least someone that knows about journalism, if you wish this site to be taken seriously?

Under EU law, one cannot stop other EU citizens from buying a property within The EU. That is just one part of why your comment is so silly. I have not got the time nor the inclination to point why your idea is so impractical in law.

Reply from – To Andrew etc etc :

If what you write is 100% correct under Law of EU Membership it still does not internally within the Powers of the Hungarian Governent forbid them stop them from writing into Law – that born Hungarians purchasing property in Hungary are given an addiditional incentive.

Foreign Investment into the Property Market all sectors of, in the past decade has been driven to the over inflated levals we see at present principally by Foreign Investment.

Who now is and will continue to pay the price even if the Central Bank of Hungary get through there idea to simplify the purchasing of property in Hungary ?

Interest rates accompanied by Inflation will continue to rise in Hungary.

The youth of Hungary continue to pay for the errors of Government that has seen them overlooked and not recognized as the Future of Hungary – those who are able to present a birth certificate that reads – place of birth – Hungary.

This article sounds a little bit like propaganda. Yes in theory everything should be easier for the young ones but let’s see what will probably happen:

1. Due to tax reduction below age of 25 I’m pretty sure all employer will reduce the offered gross salary as they will say ‘but your net is the same!’

2. Let’s say you want a very average or below average 35sqm2 apartment. It will cost you around 20million huf (55000eur) so you need ‘only’ 5500 eur to start.

3. Average salary for a fresh worker (uni or manual worker) let’s say 220000huf (600eur)

4. Anyone honestly believe that with these settings you can put away 5500 eur? Or even pay the mortgage? (18mil huf for 20 years is 100k/mo at current rate but rate will go up now with inflation)

With 600 eur/mo you are happy if you survive let alone put aside 5500 eur…