Hungarian FM: global minimum tax would be ‘coup de grace’ for EU economy

Introducing a global minimum tax for corporations would be the “coup de grace” for the European economy and put the Hungarian economy to trial, the minister of foreign affairs and trade said in Washington D.C. on Wednesday.

Péter Szijjártó is meeting representatives of ten US companies, two US senators and five congressmen, and will address a forum of Americans for Tax Reform, a conservative advocacy group, on the issue of the global minimum tax. The global minimum tax would threaten hundreds of thousands of jobs in Hungary, and essentially “reduce Hungary to the state of affairs in 2010,” the ministry quoted Szijjártó as saying.

Hungary’s low corporate tax rate, “officially 9 percent but in practice coming to 6-7 percent in view of discounts and investment support”, has been the basis of its competitiveness and the root of its investment records over the recent years, he said. The planned minimum tax of 15 percent would double that rate, he added.

Szijjártó noted that the global minimum tax was a hot topic in US politics, too, as an aim of the Democrat government staunchly rejected by Republicans. The autumn midterm elections, therefore, may bring a shakeup on the issue, he said.

So far, the US government has protested Hungary’s veto against the European introduction of the minimum tax “at several forums”, culminating in the US terminating the two countries’ agreement on the elimination of double taxation, he said.

- Read also: Fidesz: EU ‘big loser’ due to war in Ukraine

“We have high hopes that the agreement will be put into effect again once the political winds change,” Szijjártó said. So far, the political argument has made no negative impact on bilateral economic ties, he said, adding that “US companies support low Hungarian taxes”.

Company leaders are more concerned about high inflation and skyrocketing fuel and energy prices, he said. “It is important for us in Hungary to do everything in our power to remain a local exception from the great global recession,” Szijjártó said, noting the importance of price caps, curbed inflation, low taxes and utility price caps.

Read alsoKarácsony: Budapest muni council to turn to top court over central squares taken away from city

Source: MTI

please make a donation here

Hot news

What happened today in Hungary? — 25 April, 2024

Azerbaijan supplies gas to Hungary for the first time in history

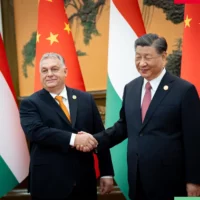

Chinese President to visit Budapest: why is Xi coming to Hungary?

Breaking: Hungarian government to sue Spar

Attention: Budapest-Vienna railway line renovation continues in Hungary, timetable changes

Orbán: Make America Great Again! Make Europe Great Again!

2 Comments

Péter Pipsqueak can barely speak English, let alone French. He would not know how to say ‘coup de grace’.

Who would NOT want a level playing field? Can Hungary only be competitive if it has an unfair advantage? Would a “bugger thy neighbor” strategy work out for Hungary over the long term? Maybe Slovakia should introduce a 5% minimum corporate income tax, then Slovenia 4%, Croatia 3% — do you see where this leads? So far, 137 countries have agreed to a 15% minimum, with Hungary being the only holdout in Europe. How is this rational? Since when is there a tax (increase) this government didn’t like?