This is what will be your identity under the GST Act

GST or Goods and Services Act has created a lot of reforms since its introduction. It has not only made the whole tax system efficient but also simplified the tax process. It brought different taxes under one umbrella. Under the previous law, there were various registrations and identities needed. GST was able to remove that and bring taxpayers and companies under one GST number – GSTIN. GSTIN or the Goods and Services Tax Identification Number is your identity as a taxpayer. To register and check GST number, you can log in to the GST portal. GST portal provides with different needs for a taxpayer. Paying taxes, filing returns, knowing about CGST act, the new amendments, or any other information.

Sponsored content

GSTIN the new tax identity

Under the GST regime, all the taxpayers have been consolidated into one single platform for administration and compliance purposes and have assigned registration under a single authority. Earlier, there were different identification numbers required for indirect tax purposes from a business. There were several places a business needed to get different identification numbers from to get registered. One of them was the Taxpayer Identification number TIN, which was provided by State Tax Authorities for suppliers, dealers, and other businesses. Under the GST regime government removed all indirect taxes and brought everyone under one tax system. With that, there was no need to get different identifications. GSTIN became the new taxpayer identity.

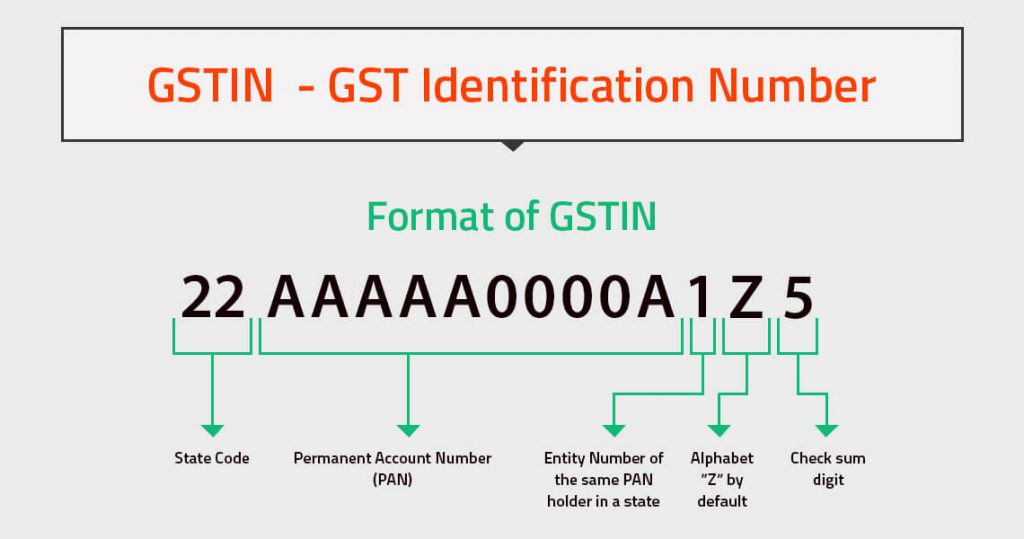

GSTIN is a unique 15 digit number.

This is a replacement for the previously used Tax Identification Number (TIN), which was assigned to different businesses by the respective state tax authorities for registering under VAT.

How GSTIN is unique

The unique identification number is allocated to each taxpayer, which is state-wise and PAN-based. The format of GSTIN is to identify the taxpayer.

- The first two digits in GSTIN represent the state code. Every union territory and state has a unique code. For example: 37 is the tax code of Telangana. 07 stands for Delhi. 24 is for Gujarat.

- The next ten digits in GSTIN are the PAN number of the individual or a business.

- The 13th digit of GSTIN indicates the number of registrations in a particular state for the same individual or company. This is an alpha-numeric number.

- The 14th number is an alphabet by default.

- The last digit is a code to detect errors. This is an alpha-numeric number.

There is often some confusion among general people that GSTIN and GSTN are the same. There is a difference in this. GSTIN stands for Goods and services tax identification number, whereas GSTN is an organization that manages the entire IT system of the GST portal. The GSTIN is used in many different ways, and it is only about the individual or the company it is assigned for. GSTN comes under the government of India, and the portal under GSTN is used for various needs of taxpayers and the government.

How to get your GSTIN

To get GSTIN, you will need to register yourself under GST. You can register for GST through the GST portal or GST Seva Kendra.

Before you go to the GST portal, you should keep scanned copies of a few documents ready as they will be needed later.

Documents needed for individuals and sole proprietorship

- Copy of your PAN card.

- Copy of Aadhaar card.

- Your photograph.

- Proof of address.

- Bank account details.

Documents needed for partnerships and LLPs

- Partnership deed of the partners involved.

- PAN card of all the partners involved.

- Proof of address of all the partners involved.

- Copy of Aadhaar card of any authorized signatory.

- Proof of appointment of the signatory.

- Proof of registration of LLP

- Address proof of business principal

- All the bank details.

Documents needed for Companies

- PAN card copy of the company.

- Certificate from the ministry of corporate affairs

- Article of Association/Memorandum

- Appointment proof of the signatory.

- Pan card copy of signatory.

- Copy of Aadhar card of the signatory.

- Copies of the PAN card of all the directors of the company.

- Proof of address of all the directions of the company.

- Proof of address of business principal.

- All the bank details.

There are similar but few other documents needed for registration of Hindu Undivided Families ( HUFs) and for the registration of Societies or Clubs.

Online Registration process

To register online for GST.

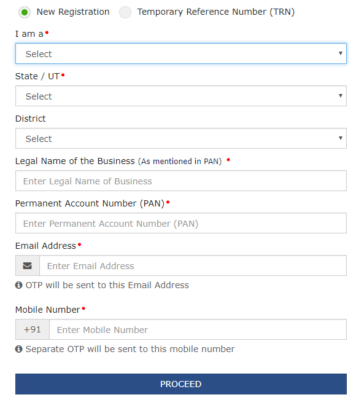

Open the GST portal and select “New Register” it will take you to a page where you will be required to enter all your details in the space provided.

Once you enter the required details like your Name, State you are from, district, Legal name of your business, PAN card number, Email address, and Mobile number. Click proceed. You will see the next page with the space provided to enter OTP. You will get two OTP numbers on your registered mobile number and your Email ID, respectively. After entering the required OTPs, click “Continue.” You will get your “Temporary Reference Number” or TRN. Open the GST portal again and click “Register Now.” Here you should choose the “Temporary Reference Number (TRN)” option and enter your TRN in the space provided. Enter captcha correctly and click proceed. A verification code or OTP will be sent to your mobile/email ID. Enter the OTP in the space provided and click proceed.

You will see that you are not fully registered yet, and the status of your application is shown as a draft. Click on the icon with clipart of a pen in the blue box under the “Action” section. A new page will open where you will be required to fill your details and submit the scanned documents. Make sure you enter correct details, and the scanned copies are clear to read with all the details clearly visible. Documents that are poorly scanned or that are not clear might not get verified, resulting in failure of registration.

Once you upload documents, you will be diverted to a verification page.

Check the declaration and submit the application using Digital signature or through OTP. A success message will be displayed. An Application Reference Number(ARN) will be sent to your registered mobile number and Email ID. You can check your ARN status by login into the GST portal. Once authorities verify and authenticate your documents. You will be registered under GST and will be able to get your GSTIN.

Conclusion

Getting a GST number will give you a unique identity. It will not only help you conduct business with confidence but will also help you build trust with others as you are legally registered. You can also check GST number of others to make sure you are dealing with a registered business or individual.

You should equip yourself with the rules and regulations of GST in the best manner.

Knowing more about GST and getting familiar about CGST act, SGST act, and IGST act will help you conduct business according to rules and avoid any issues in business from the government.

please make a donation here

Hot news

FM Szijjártó: Hungarians in Croatia have again shown force

Forint wakes to a good morning, breaks through crucial levels

Marina City: Development of Budapest’s new Danube-side city quarter begins! – VISUAL PLANS

Austria to extend border control at Hungarian border for 6 more months

Fidesz mayoral candidate Szentkirályi vows to free Budapest from Former PM Gyurcsány’s “grip”

Surprising: this is what Hungarians think about Hungary leaving the EU