Hungary to lower corporate tax rate to 9 pc from next year – UPDATE

Budapest, November 17 (MTI) – Hungary’s corporate tax rate will be lowered to a flat 9 percent next year, Prime Minister Viktor Orbán told a conference on Thursday.

The rate will apply to big companies as well as SMEs, Orbán said.

At present, the corporate tax rate is 10 percent on a tax base up to 500 million forints (EUR 1.6m) and 19 percent over that.

The government took a decision on the corporate tax rate at a meeting on Wednesday, based on a proposal by the economy minister and decisions taken earlier on payroll taxes, the prime minister said.

Orbán said he had asked Economy Minister Mihály Varga to “do everything possible” to raise the minimum wage to a level that businesses can still bear.

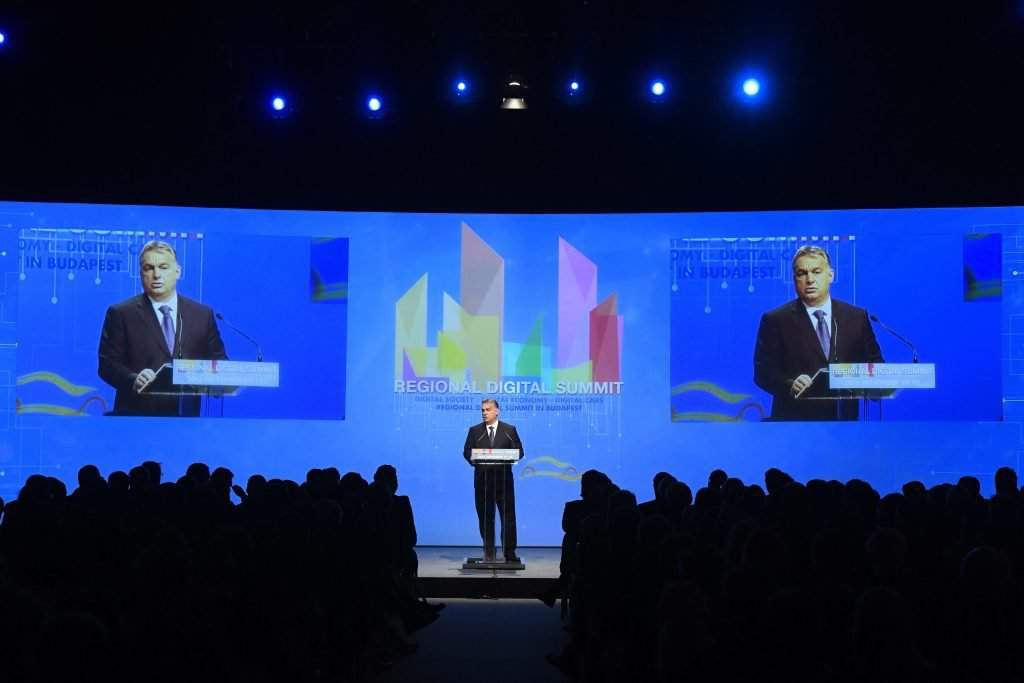

Speaking at the Regional Digital Conference in Budapest, Orbán said he had asked the European Commission to allow member states with the necessary fiscal strength to lower VAT rates on digital services if it serves their industrial policies.

Orbán said he would ask European Commissioner for Digital Economy and Society Gunther Oettinger to support the inclusion of digital services among “basic needs”.

He noted that Brussels does not support Hungary’s plan to reduce the VAT rate on internet services from 27 percent to 18 percent next year and to 5 percent from 2018.

The prime minister said digitalisation should serve the “common good” while its harmful effects should be reduced. This means that everyone should be able to profit from the opportunities presented by digitalisation, Orbán said. As regards the dangers of the internet, he noted that shielding children from harmful content was a key part of Hungary’s digital strategy. Orbán highlighted cybersecurity as another important area and stressed the need to minimise national security threats stemming from digitalisation.

Assuming that the “raw material” of the 21st century is data, storing European data in the European cloud is a fundamental national security interest for European countries, Orbán argued.

The prime minister said it was a realistic possibility that digitalisation could create as many jobs as it makes redundant, but only if the state, employers and employees all work together.

Economy Minister Mihály Varga said the lowered corporate tax rate would save companies 145 billion forints. Hungary’s new corporate tax scheme will be the most favourable in the European Union, he said.

The minister said the government wants to reach an agreement with employer and employee representatives on its tax and minimum wage proposals for 2017 and 2018 by the end of the week. If a deal is reached, the government can put a bill to parliament as early as next week and the changes can enter into force from Jan. 1, he said. This will provide a solid foundation for the economic growth rate to rise from the current 2-3 percent to around 3-5 percent, Varga said.

Answering a question, Varga said the budget would not have to be amended, as the 200 billion forints in reserves should be enough to accommodate the changes.

Source: MTI