Hungary might be the worst place to be a pensioner – Statistics

Change language:

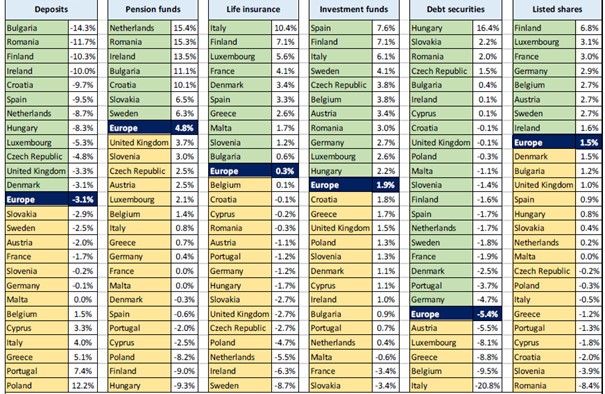

As it turns out, it is very difficult to get people to change from bank deposits to other kinds of investments, with only a few countries across Europe making progress in this matter. Interestingly, while residents of most European countries have downsized their investments in bonds in recent years, Hungarian bond investments are through the roof; there is no country in Europe with such a high proportion of bond investment among household savings in Europe as in Hungary. Unfortunately, Hungary is the last when considering savings for pension purposes, which have decreased significantly in recent years.

As Portfolio highlighted, a recent study by Efama examined the success of 25 European countries in diverting households’ financial wealth from bank deposits to other, capital market products in recent years. The study showed that the proportion of European households investing in the capital market is not as high as it was previously thought. In truth, European households only invest a small amount of their wealth into capital market products, and many households do not have any investment apart from bank deposits.

In 2008, European households held 41% of their financial assets in bank deposits, which fell to 37.1% by 2015 and have roughly remained the same since then. Between 2008 and 2019, the amount of money flowing into bank deposits reached €4,100 billion. This accounted for 61% of the net transaction in financial assets of European households at the time. The rate of assets invested in pension funds have risen from the 2008 number (20.7%) to 26.1% by 2014, but it has remained unchanged ever since.

The report points out that the crisis of 2008 and the eurozone crisis had a negative effect on the demand for investment funds until 2012. However, after this period, partly because of the low-yield environment and partly because of emerging markets, households started to invest an increasing ratio of their financial assets in mutual funds. Between 2008 and 2019, €240 billion was spent on investment funds in fresh net capital in the 25 countries studied. The rate of investment bonds have significantly dropped in the past decade for various possible reasons; meanwhile, the ratio of stock investments rose from 3.6% to 5.2%, which is a 79-billion-euro increase.

What about Hungary?

The study shows that Hungarians are different, as the population is not reluctant to invest in bonds.

Probably thanks to government-issued and guaranteed bonds, the share of bond investments far exceeds that of other examined countries. The study also points out that households in countries with lower stock deposits save more money for their pension.

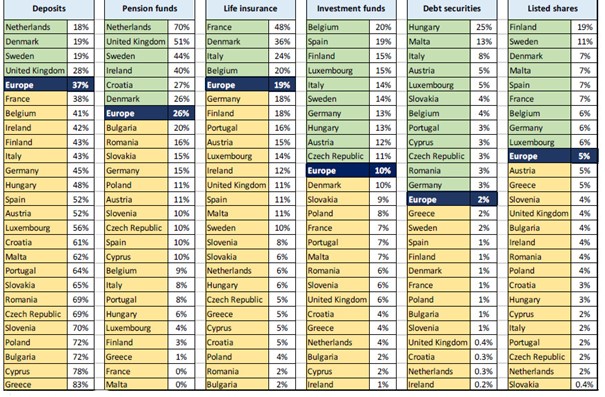

The above chart shows that Hungary:

- ranks in the middle in bank deposits with 48%, still significantly higher than the 37% of the EU average

- is the last in pension savings with only 6% compared to the average 26%

- life insurance is also 6%, while the EU average is 19%

- is well-established considering mutual funds which exceed the average (10%) by a small amount, making it 13%

- is among the first in investing bonds; it far exceeds the European average of 2%, as the ratio of household assets held in bonds in Hungary is 25%

- investment in shares is only 3%, while the average is 5%