Tesla’s streak of record deliveries encounters third-quarter challenge

Tesla Inc. has enjoyed an impressive run of consecutive quarterly car delivery records, but in the past three months, the company faced a hurdle to its winning streak in the form of factory downtime. The electric vehicle manufacturer temporarily closed some of its facilities during the summer to implement upgrades, a move that CEO Elon Musk had forewarned would result in a slowdown in production. Additionally, with inflation exerting pressure on household budgets, consumers have encountered greater difficulty when contemplating significant purchases.

Analysts’ Projections for Q3 Deliveries

According to analysts surveyed by Bloomberg, Tesla is expected to reveal its third-quarter delivery figures soon, with an estimated total of 456,722 cars. This projection falls slightly short of the 466,140 units delivered during the preceding quarter, marking the first decline since early 2022. In recent days, some analysts have adjusted their expectations downward.

Tesla’s Phenomenal 2023 Performance: Doubling Stock Value and Surpassing Market Benchmarks

In the year-to-date (YTD) performance of Tesla as of September, 2023, the company has displayed remarkable growth, achieving a YTD return of 155.90%. This signifies a substantial increase in Tesla’s stock value, which has more than doubled during 2023, a noteworthy achievement for a corporation of its magnitude. These impressive results make Tesla an attractive option for investors seeking reasons for investing in a promising stock.

The YTD increase for Tesla stands at $163.89, equivalent to 151.61%. Notably, Tesla’s YTD return surpasses those of major benchmarks such as the S&P, Dow, Nasdaq 100, Russell 2000, Gold, and the 10-Year Treasury.

These impressive gains signify a noteworthy recovery from the challenging year of 2022 when Tesla’s shares experienced a significant annual decline of 65%.

Several key factors underlie the resurgence in Tesla’s stock price. Firstly, it reflects renewed market confidence in the company’s ability to overcome obstacles and deliver value to its shareholders. Tesla’s strong market presence, innovative electric vehicle technology, and ambitious expansion strategies have been pivotal in restoring investor trust.

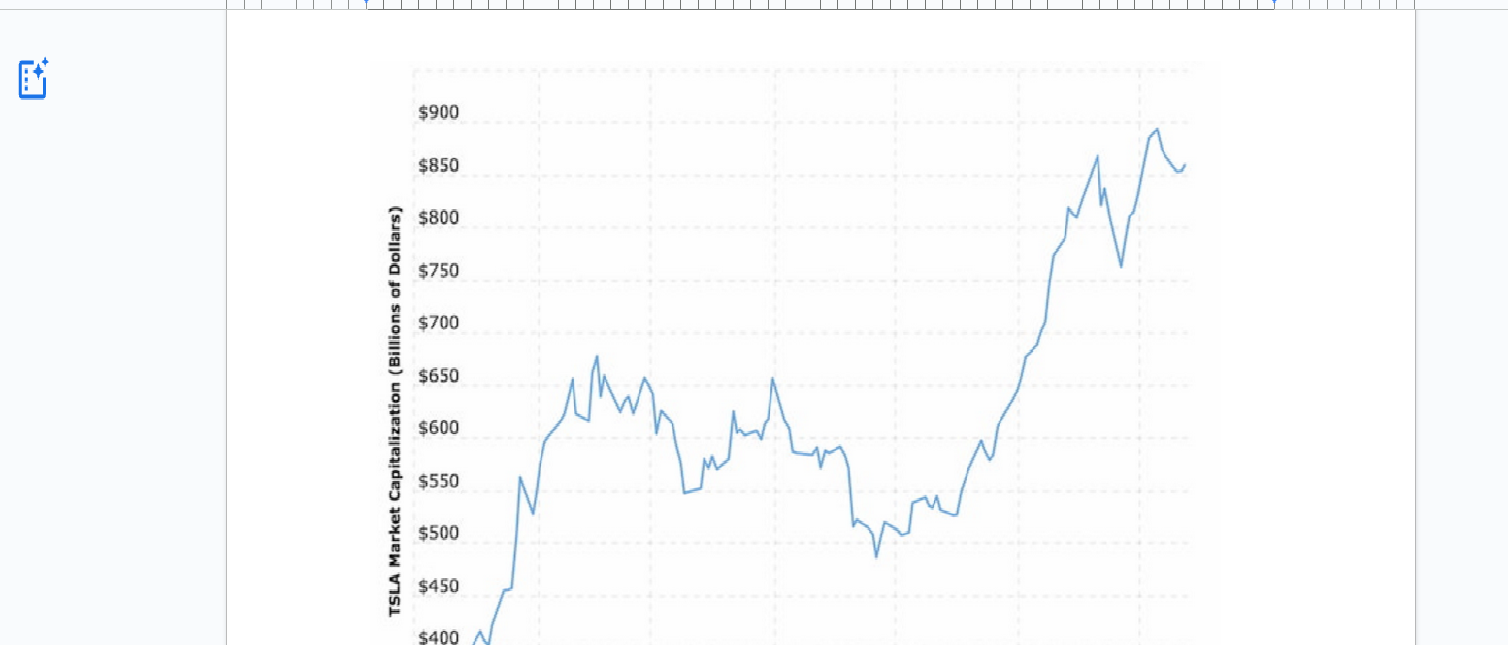

Furthermore, the surge in Tesla’s stock price has had a profound impact on the company’s market capitalization. Starting the year with a market capitalization of $342.24 billion on January 1, Tesla has seen its market cap soar to an impressive $861.12 billion as of the market close in the 2nd Quarter. This represents a remarkable increase of $518.88 billion, equivalent to a 151% surge, according to data from Macrotrends.

Strategies to Sustain Sales

Despite the production slowdown, Tesla, headquartered in Austin, Texas, has taken measures to sustain strong sales throughout the year. In response to inflation and high interest rates, the company has consistently reduced its prices.

For instance, the starting price of Tesla’s best-selling Model Y in the United States now stands at $50,490, down from $65,990 at the beginning of the year. Furthermore, the Inflation Reduction Act, passed approximately a year ago, has provided a significant boost. All versions of Tesla’s high-volume vehicles—the Model 3 sedan and Model Y SUV—qualify for a $7,500 federal tax credit, benefitting eligible buyers.

Tesla’s delivery figures come at a time when the spotlight is on Detroit, where the United Auto Workers union is engaged in a strike against General Motors Co., Ford Motor Co., and Stellantis NV, the manufacturer of Jeep, Chrysler, and Dodge vehicles. This strike occurs as the Detroit automakers navigate a costly transition from the era of internal combustion engines to electric vehicles.

Tesla’s delivery announcement is poised to mark a significant milestone for the United States, as it is expected to cross the threshold of 1 million electric car sales this year for the first time.

The Model 3 Refresh and Future Plans

The quarter also witnessed the long-awaited refresh of Tesla’s Model 3. The automaker undertook a substantial redesign of the front end of its entry-level sedan—the first major facelift since the Model 3 entered production six years ago.

While the refreshed version is not yet available in the United States, Tesla has provided limited information on when American buyers can expect to see it. Tesla manufactures the Model 3 at its facilities in Fremont, California, and Shanghai, and deliveries of the revamped Model 3 are anticipated to commence in the fourth quarter, with exports to European customers.

Investors and enthusiasts eagerly await Tesla’s upcoming model, the steel Cybertruck, inspired by the Blade Runner universe. Social media platforms, including Elon Musk’s X, have been inundated with images of the Cybertruck, but mass production remains a distant prospect. Musk has alluded to a debut party for the Cybertruck in Austin, Texas, where the first customer will receive the vehicle, but a specific date has yet to be clarified.

Analysts do not anticipate the Cybertruck contributing significantly to Tesla’s delivery volumes in the near term, given its complexity, and they expect production to ramp up gradually.

Future Production and Market Outlook

Meanwhile, when Tesla completes its factory upgrades, the company is poised to increase its car production significantly. Analysts project production exceeding 2 million units by 2024.

Deutsche Bank analyst Emmanuel Rosner stated, “Our base case now is for Tesla to guide to about 2.1 million deliveries next year, versus the current consensus of 2.3 million units. On the bright side, with the company not trying to push as much volume, there could potentially be less pricing pressure next year.”

Conclusion

In conclusion, Tesla’s remarkable streak of record-breaking car deliveries faced a challenge in the third quarter due to factory downtime and economic factors. While the quarter marked a potential decline in deliveries, Tesla’s strategic pricing adjustments and ongoing production enhancements suggest a strong future outlook, with analysts forecasting increased production volumes in the years to come.

Source: