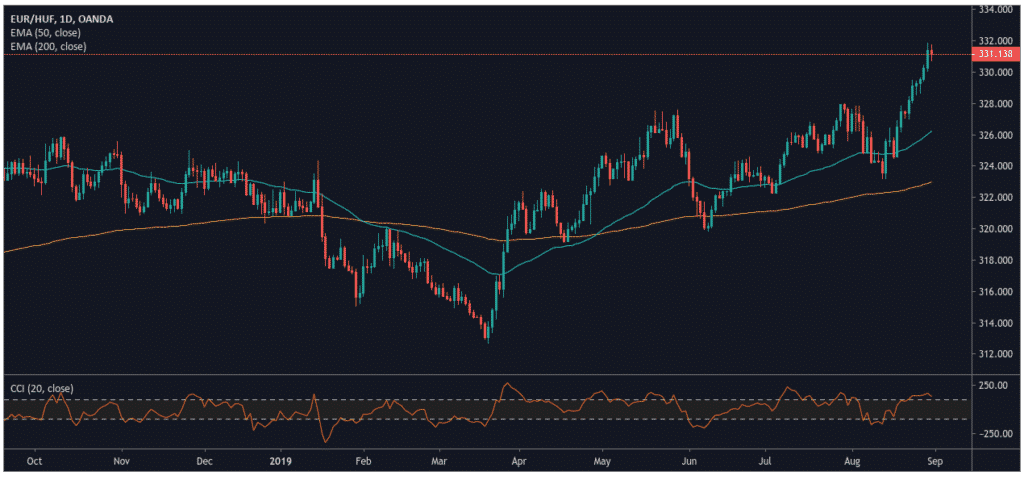

Global currencies: Record lows seen in the Hungarian Forint

In recent weeks, the national currency of Hungary reached an all-time low relative to several major currencies. Against the euro, the Hungarian currency hit 331 forints (and moving all the way to 331.87). This is the weakest price level that the Hungarian exchange rate has seen to date. Sizable losses in the forint have not been surprising, as the currency already fell to a near-record low against the euro on a few different occasions over the last few months.

The last time the exchange rate in the EUR/HUF currency pair rose above 330 was in July of 2018 (when the euro strengthened above 330.70 HUF). Hungarian economic data has supported this outlook, as the exchange rate for the U.S. dollar moved above 299 HUF and the Swiss franc hit 305 HUF in the same market activity trend.

According to many economic experts, there are a few different reasons which help to explain the record low in the forint. Investor fears related to a no-deal Brexit or the U.S.- China trade war have worked together as contributing factors. At the same time, Hungarian market assets have a negative real interest rate (one of the largest negative interest rates in the emerging markets).

Last, the major players in the world economy don’t expect monetary policy to show an increase in the near future. Inflation is holding at tolerable levels, and this is another factor that may continue to weaken the exchange rate.

Hungarian National Bank Comments

Recently, the Hungarian National Bank has said that they no target for exchange rates, saying:

“The exchange rate influences the central bank’s assessment of the situation indirectly, fundamentally via its effect on the inflation and economic outlook.”

Overall, the Hungarian National Bank is showing a dovish monetary policy stance in situations where the market is seeing loose policy amongst the major central banks. The Hungarian central bank has left the key interest rates unchanged since the middle of 2016 when the bank dropped interest rates by 15 basis points (resulting in an interest rate of 0.9% at the time).

Of course, the forint is highly exposed to trends in global markets and the widespread effect of loose domestic policies. However, Hungary has also shown a strong economic performance while trends in stringent fiscal policies have kept government bonds at attractive levels (with yields holding near record lows).

Based on the daily foreign exchange rate chart, technical analysis suggests that the continued moves in the forint may reach an eventual level of 332 against the euro. Longer-term chart analysis shows that this level might eventually reach as high as 337.

At the same time, currency rates against the U.S. dollar could extend within a range between 302 to 330. Hungarian GDP increased by 4.9% on an annualized basis during the second quarter of 2019, according to statistics released by the Central Statistical Office, which marks a slight decline from the 5.3% growth that was seen during the first quarter.

Source: