Hungary gets a boost in EU Court spat over tobacco tax suspension

In a recent conversation, an Adviser to the EU Bloc’s Top Court said that Hungary should win its European Union Court challenge of an EU decision to stall the government’s progressive taxes on retailers and tobacco companies, reports Bloomberg.

Initially, in 2015, the European Commission opened a probe into the measure and temporarily barred Hungary from collecting special taxes from retailers and tobacco companies on suspicion that the “steeply” progressive levies are violating the bloc’s rules.

However, now Advocate General Juliane Kokott of the EU Court of Justice in a non-binding opinion on Thursday has claimed that the 2015 European commission suspension was null. Additionally, she also mentioned that a lower EU court ruling dismissing Hungary’s first appeal should be overturned.

Read alsoHungary catches up with Western Europe: at least when it comes to tobacco prices

Hungary lost the first challenge at the EU’s lower court in 2018, on account of failure to apply the minimum EU threshold for excise duty on cigarettes set out in EU rules on manufactured tobacco. Hungary was allowed a long transitional period until December 31, 2017, in order to gradually increase the excise duty on cigarettes and reach the required minimum threshold.

The lower court ruling in 2018 had not been in Hungary’s favour and hence was appealed at a higher court. The Luxembourg-based court’s rulings usually follow a few months after an opinion. But with an opinion in Hungary’s favour, the ruling might also be positive.

The case is C-456/18 P, Hungary v. Commission.

Source: Bloomsberg.com

please make a donation here

Hot news

What happened today in Hungary? — 25 April, 2024

Azerbaijan supplies gas to Hungary for the first time in history

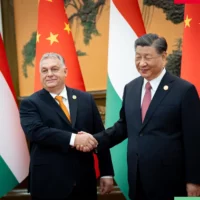

Chinese President to visit Budapest: why is Xi coming to Hungary?

Breaking: Hungarian government to sue Spar

Attention: Budapest-Vienna railway line renovation continues in Hungary, timetable changes

Orbán: Make America Great Again! Make Europe Great Again!