Hungary to be buried in state debt?

When Viktor Orbán came to power again after his landslide victory in 2010, his administration started by announcing the start of the fight against state debt. Orbán said that state debt, reaching 80 pc of Hungary’s GDP, was close to debt slavery. Therefore, the government introduced measures and started to reduce state debt successfully between 2010 and 20220. However, the debt rose to 80 pc by the end of 2020. Did Hungary lose the fight against state debt, or is there a more sophisticated answer to this question?

According to Helló Magyar, Hungary’s state debt was approximately 66 pc in 1990. That increased to a record-high 88.7 pc by 1993, but it started to fall as the economy slowly recovered after the shock caused by privatisation, the lost eastern markets, and becoming part of global capitalism. State debt reached its second inflexion point during the first Orbán administration, becoming a reference point later for Fidesz and its economic experts.

After the Socialists came back in power in 2002, state debt grew again.

It reached its second peak in the post-1990 period in 2009/2010 since the global financial crisis hit Hungary hard. During the second, third, and fourth Orbán government, state debt decreased again until 2019/2020, when the coronavirus epidemic and the lockdowns broke that trend. By the end of 2020, it reached 80.1 pc and started to decrease. Below, you can see a graph summing up all this information:

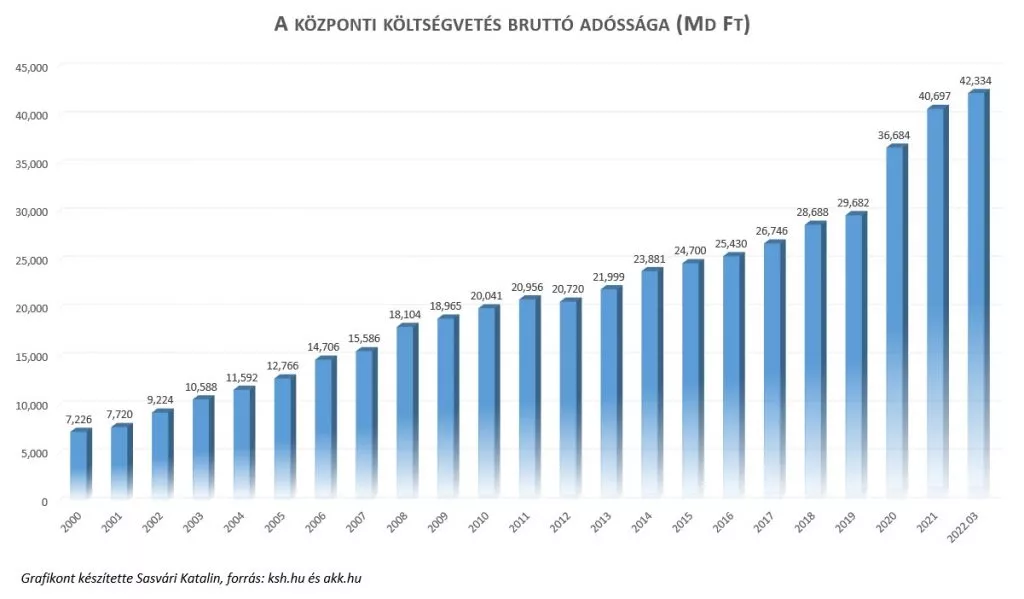

In the following graph, you can compare how much money the debt increasing and decreasing meant. Currently, Hungary’s state debt is HUF 42,334 bn (EUR 110 bn).

What are the factors that affect state debt?

Helló Magyar argues that Hungary’s economic policies and the global environment strongly influence state debt. In the current case, the following factors are the most important:

weakening forint, the interest on the debt, the 2021 economic fallback, and the money distribution before the 2022 general elections.

As reported many times, the Orbán government paid a 13th-month pension and refunded the personal income tax to families raising kids. Furthermore, they introduced a price cap on fuel and some food items. Moreover, they paid extra money for the armed forces as well.

Helló Magyar says that even though state debt had two peaks in the 2000s, the macroeconomic circumstances were different. The 2008/2009 crisis was caused by the collapse of financial markets. Meanwhile, covid harmed production.

It is not unique that the government tries to solve the economic problems caused by the pandemic by taking up loans.

In the European Union, Hungary’s state debt rate is not exceptional. However, the Hungarian state debt is expensive. On the other hand, in 2008/2009, the debt was in foreign currencies, while today, it is in forint. That is good news because today, EUR 1 is HUF 360 now, but in 2008, that exchange rate was 1:252.

Why is state debt growing?

The parliament accepts every state budget with a deficit each year. Compared to the 2008/2009 period, there have been some positive changes. For example, Hungary managed to halve its loans in foreign currencies and extended its repayment period from 4 to 6 years in general. As a result, the government always has enough time to find enough financial resources to pay back old debts.

High state debt does not mean a country’s economy cannot flourish. For example, the USA, Japan, and Belgium have more robust state debt than Hungary. Of course, high debt raises financial risks and makes additional loans more expensive.

To sum up, though Hungary has not lost the war against state debt, it has a lot of lost battles. The fifth Orbán administration’s most difficult job will be to reduce state debt and inflation, fill the gaps in the country’s budget, and help economic growth.

Source: Helló Magyar