The rise in Hungarian housing prices tops the entire EU!

Change language:

Compared to 2010, housing prices in the EU only grew at a higher rate in Estonia than in Hungary. Compared to 2015, the increase in Hungarian housing prices is beating the entire EU field.

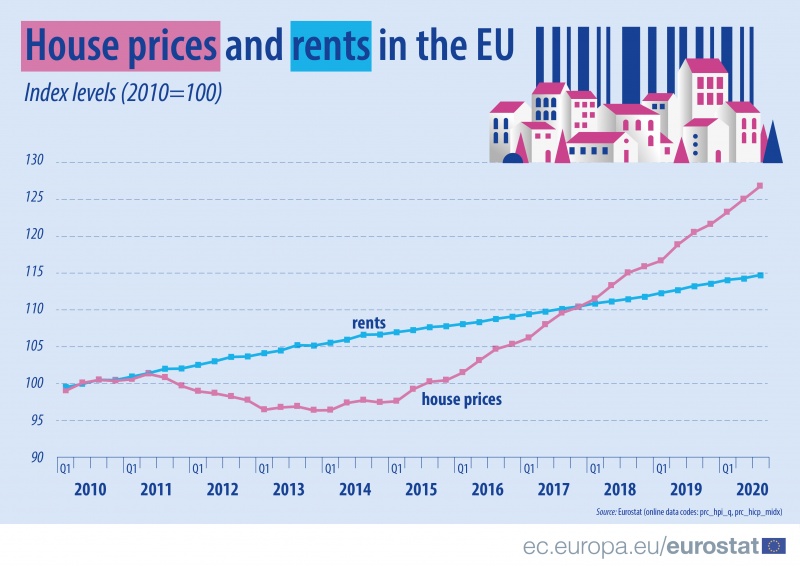

According to HVG, until the third quarter of 2011, the average rent and housing prices in the European Union (27 countries) were characterised by constant fluctuation. A sudden change hit the market then, and the two went on different paths: rents started rising steadily and steadily, while housing prices fluctuated significantly.

Housing prices fell sharply until early 2013, stagnating that year and the following, and then began to rise sharply in 2015, much faster than the pace of rents. Comparing 2020 to 2010, rents rose by an average of 14.6 percent, while housing prices rose by 26.8 percent.

This trend is characteristic of 16 Member States.

The highest rise can be noticed in the following countries:

- Estonia (by105 percent),

- Hungary (by 92 percent),

- Luxembourg (by 90 percent).

On the other hand, housing prices fell in Greece, Italy, Cyprus and Spain.

If we compare the prices of 2020’s Q3 not to 2010, but to 2015, then the growth was the largest in Hungary, and outstandingly, the prices increased by 80 percent, while the EU average was only 28 percent.

In terms of rents, Estonia also leads the list in comparison to 2010 (an increase of 136 percent). Hungary is not at the forefront in terms of rent growth.

Source: www.hvg.hu

My unequivocal position communicated numerious times as a commentator through this newspaper remains.

The February 2020 period and prior over (24) months – the period of the “apex” in the property market in Budapest, Hungary, hitting a “brick wall” in March 2020 through the arrival of the novel coronavirus, was “driven” and “exploted” through Foreign Investment.

February 2020 – the (24) months prior to this date, the property market in Budapest, Hungary – the (3) three countries of property investors into Hungary’s property market – in this order :

(1) – China.

(2) – Vietnamese.

(3) – German.

The dominence and vibrant activity as buyers and investors of these (3) three cointries, are the principal catalyst – reason – the property market the distorted lack of clarity and deformity, totally lacking in soundness of economic rational – property values in Budapest, Hungary reached the FALSE position of high levels that was witnessed to February/March 2020.

Foreign Property Driven Investment – separated from part or permanent residency but greater emphasis placed in purchasing properties for Rental Income.

Hungarians – from “all stations of life” deserve better and greater assistance to purchase or invest in the property market.

Hungary – must ensure they are seen as a greater player in the property market, by creative measures arising out of Government, that creates investment opportunities for them, and not be “steamrolled” or out positioned by Foreign Investment into property on the lands of Hungary.