Change language:

After historic lows, Hungary’s forint faces possible further decline with today’s S&P credit rating – UPDATED

S&P is set to announce Hungary’s credit rating late tonight, a decision that could exacerbate the downward trend of the forint. On 23 October, the Hungarian currency reached a 22-month low against the euro, a position it has struggled to recover from since. The last time the forint was this weak was back in January 2023.

Could Trump’s defeat aid the forint?

The forint has proven vulnerable to external shocks, with recent pressures arising partly from the U.S. presidential election campaign, according to portfolio.hu. The campaign’s impact on emerging markets has put additional pressure on the currency, but interestingly, a Democratic victory could potentially ease this strain on the forint.

Interestingly, a Democratic victory in Washington could help the forint recover from its current downturn. However, the Hungarian government has placed all its bets on a Trump victory. Prime Minister Orbán and his cabinet hope that a Trump presidency could alleviate the pressure from some Western powers on Hungary regarding the war in Ukraine and the illegal migration crisis. Orbán frequently asserts that Trump would bring peace to Ukraine, which would help the Hungarian economy flourish once again.

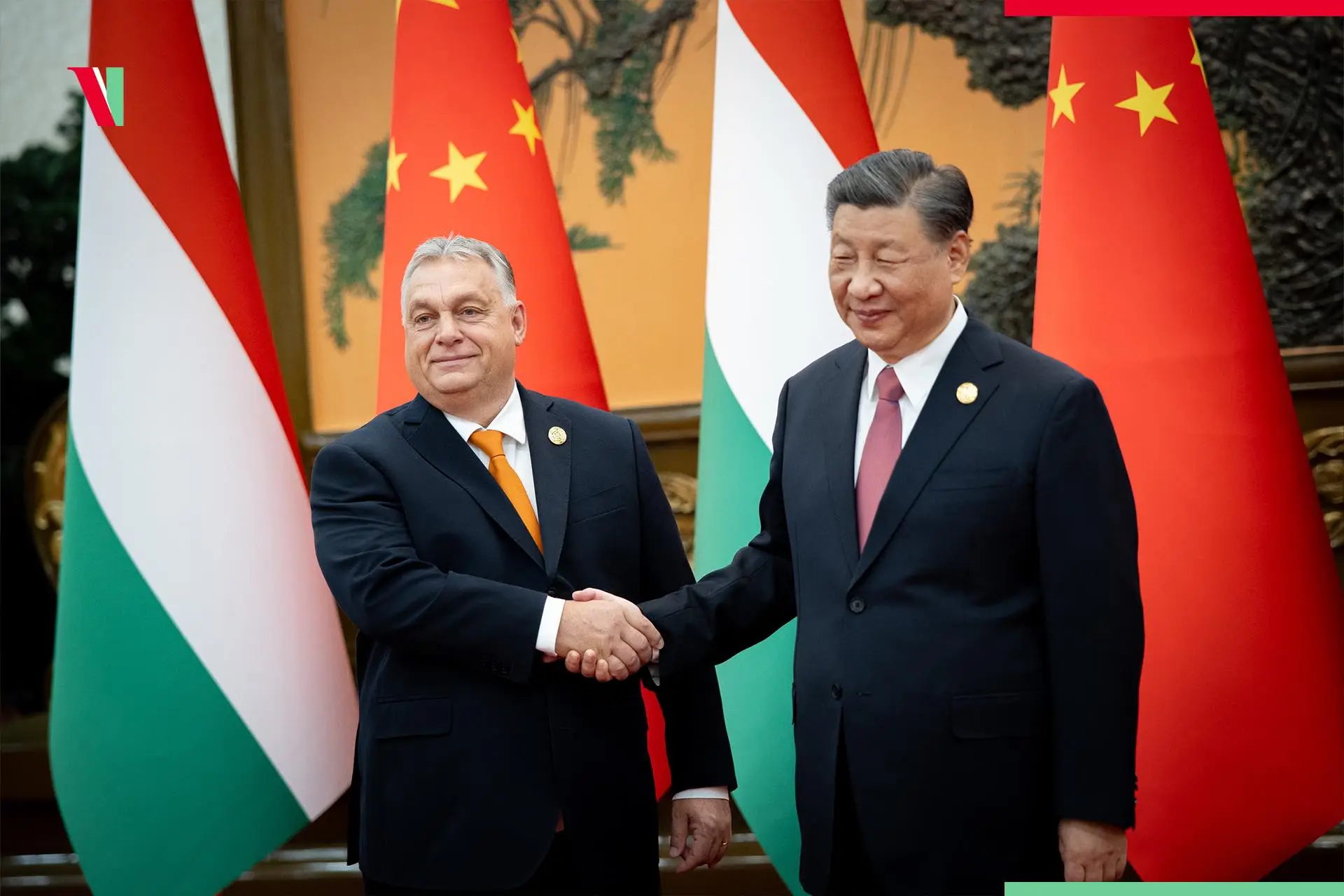

On the other hand, the Hungarian PM rarely mentions Trump’s anti-China policies, which could lead to clashes between Budapest and Washington. The Hungarian government is actively working to establish, maintain, and expand its relations with China in various areas, including education, the economy, railway upgrades, and even financing Hungary’s growing debt.

Conversely, a Republican victory in both Congress and the White House could lead to a stronger U.S. dollar, presenting new challenges for the Hungarian currency.

Can the Hungarian National Bank (MNB) stabilise the forint?

The Hungarian National Bank has pledged to keep the base interest rate steady for at least the next three months in an effort to support the Hungarian currency. Portfolio.hu suggests that further intervention from the MNB may only occur if the forint weakens uncontrollably. Some analysts predict the forint could strengthen to around 400/EUR by year-end, but a sustained softening is anticipated for 2025, with the exchange rate likely remaining above this threshold.

The forint’s decline is partly due to Hungary’s sluggish GDP growth and ongoing delays in receiving EU funds. Poland’s zloty, though also under pressure, has held steadier due to Poland’s stronger growth and EU financial support.

Will S&P retain Hungary’s investment-grade status?

According to Portfolio.hu, S&P is likely to maintain Hungary’s investment-grade rating with a stable outlook, following a similar move by Japan’s R&I on 22 October.

The forint traded at 404.22 to the euro around 10:00 on Friday morning, weakening from 402.78 late on Thursday. The current exchange rate stands at 403.75. The forint also eased to 373.50 from 372.92 against the dollar and slipped to 431.24 from 430.31 against the Swiss franc.

In June, all three major credit rating agencies—Fitch, Moody’s, and Scope Ratings—maintained Hungary’s position in the investment grade category.

UPDATE: Euro above 404

The forint traded at 404.08 to the euro around 5:30 in the evening on Friday, slipping from 402.78 late Thursday. The forint eased to 373.44 from 372.92 against the dollar. It weakened to 431.12 from 430.31 to the Swiss franc.

UPDATE 2: S&P decision and reactions

S+P Global Ratings affirmed its ‘BBB-/A-3’ long- and short-term foreign and local currency sovereign credit ratings on Hungary in a scheduled review on Friday. The outlook is stable. However, the positive news did not help the forint. On Saturday morning, the exchange rate is still 403.92/EUR.

“The stable outlook reflects our expectation that Hungary’s economic recovery, ongoing disinflation, and stabilising cost of debt will support the government’s fiscal consolidation efforts in the medium term, allowing the government’s debt burden…to stabilise,” the rating agency said.

S+P sees Hungary’s fiscal deficits narrowing from 2025 and averaging 3.7pc of GDP through 2027, taking into consideration strengthening economic prospects and active consolidation measures totaling about 1.3pc of GDP for 2024.

S+P expects Hungary’s state debt ratio to reach 74.6pc of GDP in 2024 and projects interest spending to represent 9pc of government revenue on average over 2025-2027.

S+P’s baseline expectation is for inflation to continue to subside and the current account to remain in modest surpluses, allowing the National Bank of Hungary to cautiously normalise monetary policy.

S+P puts GDP growth at 1.6pc in 2024, before accelerating to around 3.0pc in 2025 as investment growth and external demand recover, alongside “enduring private consumption”.

S+P said the growth outlook remained “somewhat uncertain” as the country’s open and trade-intensive economy remained susceptible to external developments, including growth performance in Germany, Hungary’s key trading partner, as well as any spill-over effects from geopolitical tensions on energy or other key import prices.

Hungary’s constrained relations with the EU could also lead to delayed disbursement of associated funding, it added.

Hungary has access to a total of EUR 12.2bn of cohesion funds for the EU’s 2021-2027 funding cycle.

FDI as a share of total investments is expected to pick up on big projects in the electric vehicle sector, S+P said.

In a statement released late Friday, the National Economy Ministry attributed the high degree of confidence in Hungary in the reports of all three big credit rating agencies to the stability and resilience of the economy.

The economy is growing faster than the European Union average and beating economic performance in Belgium, France, Italy, the Netherlands, Romania, Latvia and even Germany, the ministry said.

Hungary has moved past a difficult period and positive signs point to an economic turnaround, it added.

GDP growth is expected to reach 1.5pc in 2024, the ministry said, pointing to improving retail sales and tourism data, indicating growing consumption. The recovery of the domestic economy is supported by high employment, a dynamic increase in real wages and low inflation, it added.

The government aims to boost GDP growth to 3-6pc, adopting a policy of economic neutrality and rolling out a new economic policy action plan that aims to boost purchasing power, ensure affordable housing and upscale SMEs, the ministry said.

The 21 measures could lift GDP growth over 3pc in Q1 2025, it added.

In a post on social media late Friday, Finance Minister Mihaly Varga noted that Hungary’s sovereign rating had been reviewed by credit rating agencies close to 20 times since the outbreak of the war in Ukraine. Each time the agencies have established that the economy is resilient and the conditions for growth are in place, putting Hungary in the investment grade category, he added.

Hungary’s economy is returning to the path of sustained growth it was on before the pandemic, he said.

Read also:

This article describes some of the situations as uncontrollable elements, like the rain or the sun.

However, access to EU funds, competitive economy, strategic alliances and others are direct responsibilities of the government in power for a decade.

In addition, hedge funds highlighted the unproductive Hungarian economy where taxpayer’s money goes to oligarchs. It doesn’t matter how much money the government has as long is wasted

Gabor – Concur.

It just reverts back to the FAILED – Economic & Financial Policies, implemented in Hungary, no greater evidence needed post the Covid Pandemic, the DISASTERS of Orban and his “Dub” – Minister of Finance – Mihaly Varga policy’s they introduced.

Orban & Varga – where WARNED by “Learned” brains of greater Economic & Financial capabilities – of there FATAL Path, they committed – signed off on, which has resulted in the Economic & Financial CHAOS of our Economy today.

Orban & Varga, plus the Fidesz Government of Hungary have STRANGULATED, backed the Hungarian Economy into a corner, backs to the wall, that there ESCAPE to rescue in any FORM or Policy’s just WORSENS.

Orban – his Fidesz Government – will continue to RAISE taxes in Hungary not forgetting the Double Dipping they already do, through the VAT of 27% highest of the 27 European Union Member country’s.

Government Debt – through Orban and Varga continues to ESCULATE in Hungary, which sadly is Citizens DEBT – that they through there taxes have to pay.

Hungary – after 15 years and what have we got – a TRASHED Economy and right across all the componentry of the Hungarian Financial and Economic “landscape” inclusive of Infrastructure – just a cataclysmic CHAOTIC Mess.

What a disgrace, a complete ABOMINATION.

Hungary – we have been FAILED.

Brace ourselves for it is WORSENING.

These “credit rating agencies” are a bunch of gangsters that are effectively operating parallel governments. They decide they don’t like a country’s government, they issue a credit rating “warning,” it spooks investors and savers, and the economy–with which there was nothing wrong to begin with–tanks.

They need to be put out of business, period.