Only a few people hold the third of Hungary’s wealth

Change language:

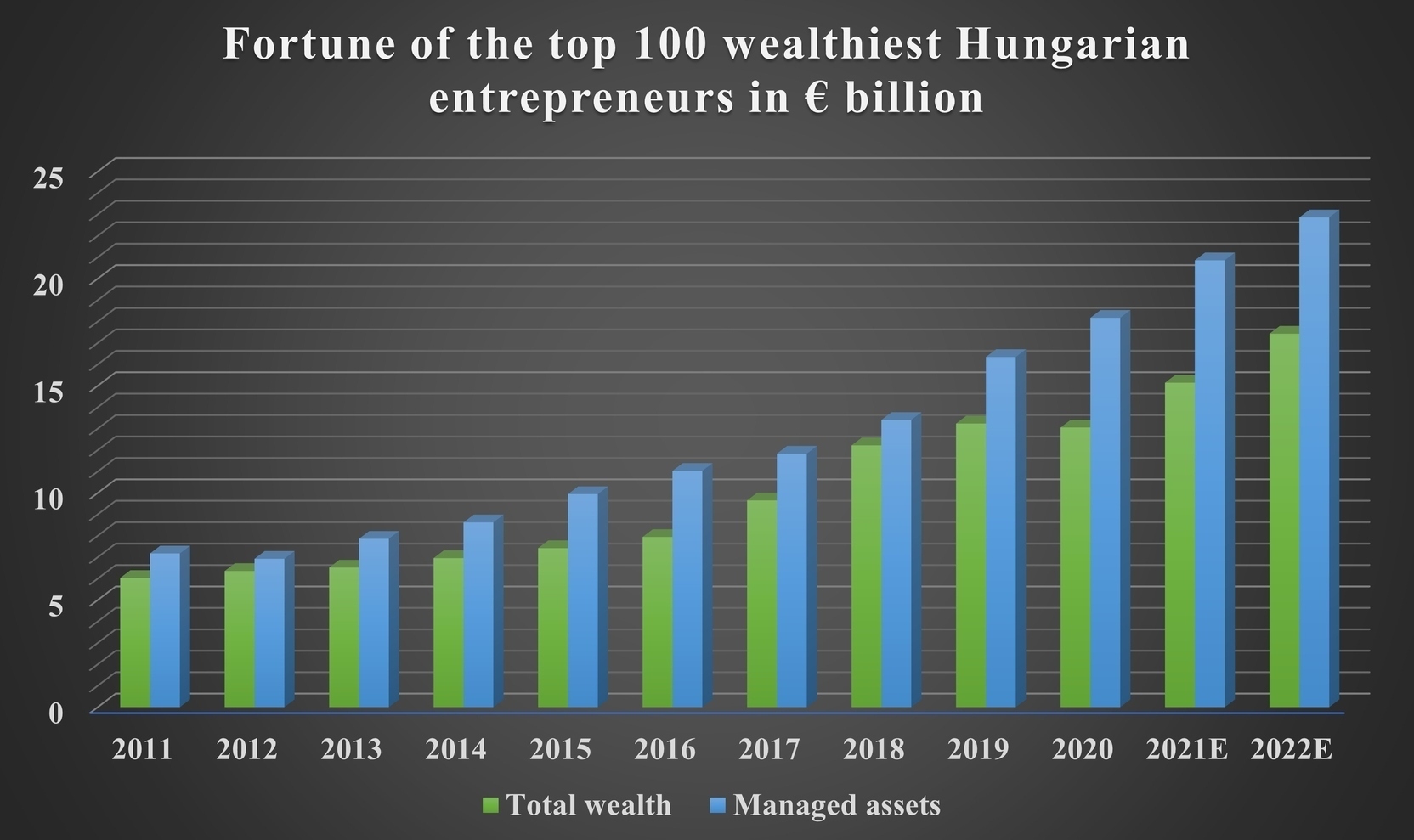

In Hungary, currently 4,000-4,500 of the wealthiest families control 30 percent of the total domestic net fiscal assets.

This narrow stratum accounts for more than 5 percent of Hungary’s total retail bank account and securities savings. Additionally, only they have more than 300 million forints (€ 857,000) of monetary wealth, not counting properties, says Index.

According to experts handling the fortune of Hungary’s wealthiest people, there is an additional problem as well. It turns out that in most such families, the generation change has not taken place yet.

This means that the wealthy individuals are not likely to bolster their successor’s wealth and positions, Azénpénzem writes.

To shed light on the problem, Blochams created a publication concerning “generational strategy building for the first joint family wealth planning steps”. Blochamps has presence in the financial sector since 1998.

“During the last 10 years Blochamps has been providing business consultancy and advisory services for Hungarian private banking service providers.” They are the most prominent independent advisory company in the Hungarian private banking market, as they say on their website.