BREAKING: Euro/forint exchange surpasses 400

The forint traded at 398.68 to the euro around 10:00 in the morning on Wednesday, softening from 398.08 late Tuesday. At 1 PM on Wednesday, the exchange rate was even closer to 400, hovering over 399.43.

According to Portfolio, current trends suggest it’s only a matter of time before the EUR/HUF exchange rate exceeds the critical psychological threshold of 400. The Hungarian currency has weakened by more than 5 units against the euro in just one week, causing the EUR/HUF rate to rise to levels not seen since early August, approaching 400.

The article also highlights a shift in the dollar-forint exchange rate, which could place further pressure on Hungary’s currency in the coming days.

Economists predict that the euro could soon surpass HUF 400.

On Wednesday morning, the forint slipped to 360.23 from 359.73 against the dollar. It weakened to 426.05 from 425.31 to the Swiss franc

UPDATE: EUR/HUF reaches 400

The Hungarian currency has fallen, with the euro above 400 forints at 3.18 PM on Wednesday. The exchange rate hasn’t been this weak since March, and according to Economx, there is no rationale for a forint rise now.

Read also:

Hungary rejects EU’s punitive tariffs on Chinese EVs

Minister of Foreign Affairs and Trade Péter Szijjártó said in New York late Monday that Hungary opposes the European Union’s punitive tariffs on Chinese electric vehicles.

Earlier, Szijjártó met with his Chinese counterpart, Wang Yi, to discuss the implementation of agreements signed in May, during a visit to Hungary by Chinese President Xi Jinping, the development of ties between Europe and China, and political steps on the global stage in the interest of peace, the Ministry of Foreign Affairs and Trade said.

“Hungary is a good example of the big economic benefits a civilised East-West cooperation can bring,” Szijjártó said, pointing to business partnerships between Western European and Chinese automotive industry companies to advance electromobility.

He said that the EU’s competitiveness could improve “dramatically” if it cooperated with China instead of “creating confrontation.”

In that context, levying punitive tariffs on Chinese EVs is “a very bad idea,” he said, adding that European automotive industry companies are “protesting the measure tooth and nail.”

“Hungary is against the tariffs and will vote against them. And we hope that in the coming years, a civilised, sensible economic cooperation based on mutual respect can be established with China,” he said.

Hungary “greatly appreciates” the Chinese-Brazilian peace initiative, Szijjártó said. He added that Hungary would continue cooperating closely with China to promote global pro-peace efforts.

Read also:

- VSquare: Hungary acts as middleman for China’s EUR 500 million loan to Orbán’s Balkan allies

- Audi unveils the CUPRA Terramar: new model to be manufactured in Hungary

Hungary sees significant growth in wages in July

Net wages climbed at the same pace to HUF 423,400 (EUR 1073), KSH said.

Real wages rose 9.4pc, calculating with July CPI of 4.1pc.

The gross median wage increased 16.5pc to HUF 524,100 (EUR 1328).

From December 1, Hungary’s statutory monthly minimum wage was raised by 15 percent to HUF 266,800 (EUR 676) for unskilled labourers and by 10 percent to HUF 326,000 (EUR 826) for skilled workers.

Excluding the 66,000 Hungarians working full-time in fostered work programs—who earned an average gross of HUF 132,000 in July—the average gross monthly wage was HUF 647,400.

The average gross wage in the business sector, which includes state-owned companies, rose 12.7pc to HUF 639,000 (EUR 1619), excluding fostered workers. The average gross wage in the public sector, without fostered workers, climbed 17.6pc to HUF 672,000 (EUR 1703).

In the non-profit sector, the average gross wage, without fostered workers, increased 15.8pc to HUF 667,900 (EUR 1692).

Hungarians employed in the financial and insurance sector were the highest earners in July, with an average gross of HUF 1,010,300. People working in commercial accommodations and catering earned the least, with HUF 406,900.

For January-July, gross wages averaged HUF 635,000, and net wages came to HUF 422,300, both up 14.0 percent from the same period a year earlier.

As we wrote earlier, Orbán cabinet targets ‘significant’ minimum wage rise for 2025.

- read also: Here is when the new Hungarian Golden Visa scheme starts: will Hungarian and Chinese businessmen supervise it?

Featured photo: depositphotos.com

Where does Hungary rank on the list of the best countries in the world?

The ranking of the best countries in the world made by U.S. News & World Report was published recently. Here’s where they have placed our beloved Hungary on the list.

U.S. News & World Report’s list

As Mfor writes, the 2024 Best Countries in the World report by U.S. News & World Report ranked 89 nations, with Hungary placed 54th overall. Highlighting global perception rather than aesthetics, the rankings consider multiple factors. According to David Reibstein of the Wharton School, the list emphasises a country’s strong international image.

Cultural influence, for example, includes entertainment relevance, modernity, and brand presence. Hungary ranked 55th in this category. Countries were assessed across ten categories, including economic and social power, entrepreneurship, business openness, agility, social goals, quality of life, drive or motivation, cultural influence, heritage and adventure, with each scored out of 100 to determine the best countries in the world.

Hungary’s place on the list

Hungary ranked 54th in the 2024 Best Countries in the World list, a slight drop from its 49th position in 2023. Despite this, Hungary performed better than some of its neighbours but trailed behind Austria (21st), Croatia (47th), and the Czech Republic (50th). Interestingly, India, despite having nearly 230 million people living in poverty, was ranked 33rd. The report provides detailed data for each country, such as population, GDP, and language spoken. For Hungary, it highlights the nation’s linguistic isolation and relative economic prosperity compared to other European countries.

The report also discusses Hungary’s strained international relations, citing its anti-immigration policies and the centralisation of political power as key issues. The political climate is noted as being in line with the growing populism and far-right movements across Europe. Additionally, critics, including the US, have pointed to corruption within Hungary’s government and alleged smear campaigns against civil society groups. Despite these challenges, Hungary remains notable for producing one of the highest number of Nobel laureates per capita, though many achieved success abroad due to limited funding at home.

The best countries

Denmark ranked tenth in the 2024 World Best Countries report, excelling in quality of life and social goals, including human rights and equality, while also being the top country for child-rearing. New Zealand secured ninth place, praised for meeting social objectives and providing a comfortable retirement. The United Kingdom came eighth, still highly regarded after Brexit, particularly in areas such as power and entrepreneurship. Germany ranked seventh, leading in entrepreneurship but falling behind in retirement conditions.

Sweden ranked sixth, dropped from third place last year but remains a global leader in environmental protection and quality of life. Australia was ranked fifth, standing out for retirement conditions, while Canada placed fourth, known for its quality of life and social goals. The United States rose to third, excelling in agility, power, and education, though it trailed in cultural influence. Japan took second place, leading in business and career development, while Switzerland maintained its top position, excelling in career opportunities, retirement conditions, and overall quality of life.

Read also:

- Budapest in the middle of the pack among world’s late dining capitals

- Budapest among the most affordable European destinations this fall

Featured image: depositphotos.com

Temporary relief: inflation in Hungary eased in August

In August, Hungary saw a temporary easing in inflation, with the rate falling to 3.7% from 4.1% in July. However, this data does not account for the impact of the summer drought on prices, and analysts suggest that the effects on the Hungarian economy will only become evident in the autumn.

According to economists consulted by Portfolio, domestic inflation may have decreased to 3.7% in August, down from 4.1% the previous month. Analysts attribute this decline primarily to base effects. However, they expect inflation to gradually increase towards the end of the year, with many predicting it could exceed 5%.

“The inflation rollercoaster may have continued in the last month of the summer: after a significant rise in July, we are now seeing a greater moderation,” said Péter Virovácz, a senior analyst at ING Bank. He noted that several specific factors contributing to the July spike in inflation are unlikely to be present in the August data. For example, food prices rose in July due to the introduction of price caps and the end of compulsory shop sales, Világgazdaság reports.

Fuel prices also fell in the first twenty days of August, which likely played a significant role in curbing one-month inflation. Virovácz does not foresee another substantial rise in food prices like the one in July, suggesting that inflationary pressures from this sector may be lower.

Additionally, the global decline in consumer durable prices, along with the relative stability and slight strengthening of the forint, indicates that price changes in this category could have been slightly negative each month.

Gábor Regős, Chief Economist at Granit Fund Management, stated that while fuel prices have minimally reduced inflation compared to their positive contribution in the previous month, the main concern remains the rise in service prices. Although monthly repricing was more moderate than in July, it continues to be the most significant factor driving up the overall price level. Regős expects consumer prices to have increased by 0.2% on a monthly basis, with last year’s high base potentially causing the annual index to fall from 4.1% to 3.6%.

Some analysts believe that weak demand may already be restraining inflation in services. Zsolt Becsey, Chief Economist at MNB, noted that the significant price increases in services seen in the spring did not trigger a new wave of inflation over the summer. Regős pointed out that second-quarter GDP data showed that expanding demand for services played a large role in boosting consumption, with service sectors capitalising on this demand.

Analysts warn inflation could rise again

Dániel Molnár, Senior Analyst at the Macronome Institute, noted that food prices may have stagnated in August but could rise slightly in the coming months due to weaker agricultural production and increased import demand. He forecasts that inflation may have returned to the central bank’s tolerance band at a rate of 3.6% in August, with a 0.2% increase in consumer prices on a monthly basis.

According to Világgazdaság, inflation is expected to remain within the tolerance band in September, accelerate temporarily from October due to base effects, and approach 5% by the end of the year. It is projected to start decreasing again from early next year, reaching the inflation target by the summer of 2025. Zsolt Becsey also emphasised that despite the spring price hikes in services, demand remains weak, limiting businesses’ ability to raise prices further.

Read also:

- Did Orbán accidentally reveal the new Governor of the National Bank of Hungary? – Read here

- Orbán cabinet acknowledges that food prices skyrocketed in Hungary – investigation begins – Read here

National Economy Minister stresses need to boost competitiveness at Eurofi Conference

National Economy Minister Márton Nagy said Europe was lagging in the race with its global competitors, addressing a conference organised by Eurofi in Budapest, his ministry said on Friday.

Nagy told the European Union economic and financial decision-makers at the conference that strengthening the competitiveness of the EU and its members states was “vitally important”. He said Hungary had drafted a new competitiveness deal in the framework of its presidency of the Council of the EU and would present it in October.

Commenting on the Draghi report on European competitiveness released days earlier, Nagy said the financial sector played a “key role, as a catalyst” for boosting competitiveness. He added that players in the sector needed support in the areas of sustainability and digitalisation, while noting that consumers and consumer protection remained a priority.

At a roundtable discussion at the conference, Anikó Túri, a state secretary at the National Economy Ministry, pointed to the risk of refined methods of fraud that had developed parallel with the fast pace of digitalisation. She said that boosting financial awareness was key to addressing that risk, a responsibility that needed to be shared by governments and financial services providers.

Economy minister meets with EBRD president

Mr Nagy met with Odile Renaud-Basso, the president of the European Bank for Reconstruction and Development (EBRD), in his office in Budapest on Friday, his ministry said.

read also:

- Unveiled: How Hungary plans to spend the Chinese loan funds

- Leaked – PM Orbán behind closed doors: 2026 can mark the end

ECOFIN meeting kicks off in Budapest, key priority for sll EU countries

Strengthening the European Union’s competitiveness, a priority of Hungary’s presidency of the Council of the EU, is the main topic of an informal meeting of EU economy and finance ministers in Budapest, Finance Minister Mihály Varga said on Friday.

Ahead of the ECOFIN meeting

Speaking ahead of the meeting, Varga said all conditions were in place for a successful ECOFIN meeting, both regarding participants and topics on the agenda.

He added that all EU member states were represented at the meeting, most of them at a high level. The heads of member states’ central banks were present, too, along with representatives from the IMF, the OECD, the EBRD, and the EIB.

He said the meeting had been arranged around topics Hungary had already gained experience with, such as financing for the green transition. He added that potential options for EU support for low-income countries to manage their debt was also on the agenda.

On Saturday, he said participants would discuss current demographic processes related to national debt sustainability.

Informal meeting

He noted that the meeting was informal and no decisions would be taken.

Varga said he was confident that the meeting would result in advances in areas necessary to strengthen the EU’s competitiveness.

As we wrote today, IMF backs Hungary’s ambitious EU presidency goals.

read also:

- Leaked – PM Orbán behind closed doors: 2026 can mark the end

Hungarian government: European Capital of Culture title presented opportunity to ‘reposition’ region of Veszprém

The title of European Capital of Culture, which the town of Veszprém and the Lake Balaton region held last year, presented a good opportunity to “reposition” the region, the regional development minister told an international conference assessing the experiences of the programme and the opportunities of the region.

Repositioning Veszprém

Tibor Navracsics praised the region’s richness in historical landmarks, natural beauty, culture and traditions, and said it was on par with “other, more popular touristic regions in western Europe”.

The programme aimed to strengthen local communities, “and to showcase Hungarian elements in European culture and European traits in Hungary’s culture,” Navracsics said.

Organisers have emphasised the reconstruction of buildings rather than infrastructure as it is habitual during the ECC year, and they focused on sustainability, he said.

The programmes involved 116 localities, in a co-financing model that made sure every locality contributed to the success, he said.

Hopefully, the region would go on to become a “creative region”, with the creative industries dominant in its economy, he said. Infrastructure developments would be another feature to focus on, he added.

Read also:

Orbán cabinet targets ‘significant’ minimum wage rise for 2025

The government aims for a “significant” increase in the minimum wages for skilled and unskilled workers next year, Gergely Gulyás, the head of the Prime Minister’s Office, said at a regular press briefing on Thursday.

Gulyás talks about minimum wage rise in Hungary

Mr Gulyás said the government wanted to see an agreement on minimum wage increases that spanned several years, in the interest of predictability, while the minimum wage should be linked to the average gross wage. He added that National Economy Minister Márton Nagy was given a mandate to negotiate with unions and employers.

Mr Gulyás said the cabinet had discussed the targets for next year’s budget, but not the budget itself.

Read also:

- Orbán promises to increase wages and family subsidies

- Latest average earnings in Hungary: updated income statistics and trends

Featured image: depositphotos.com

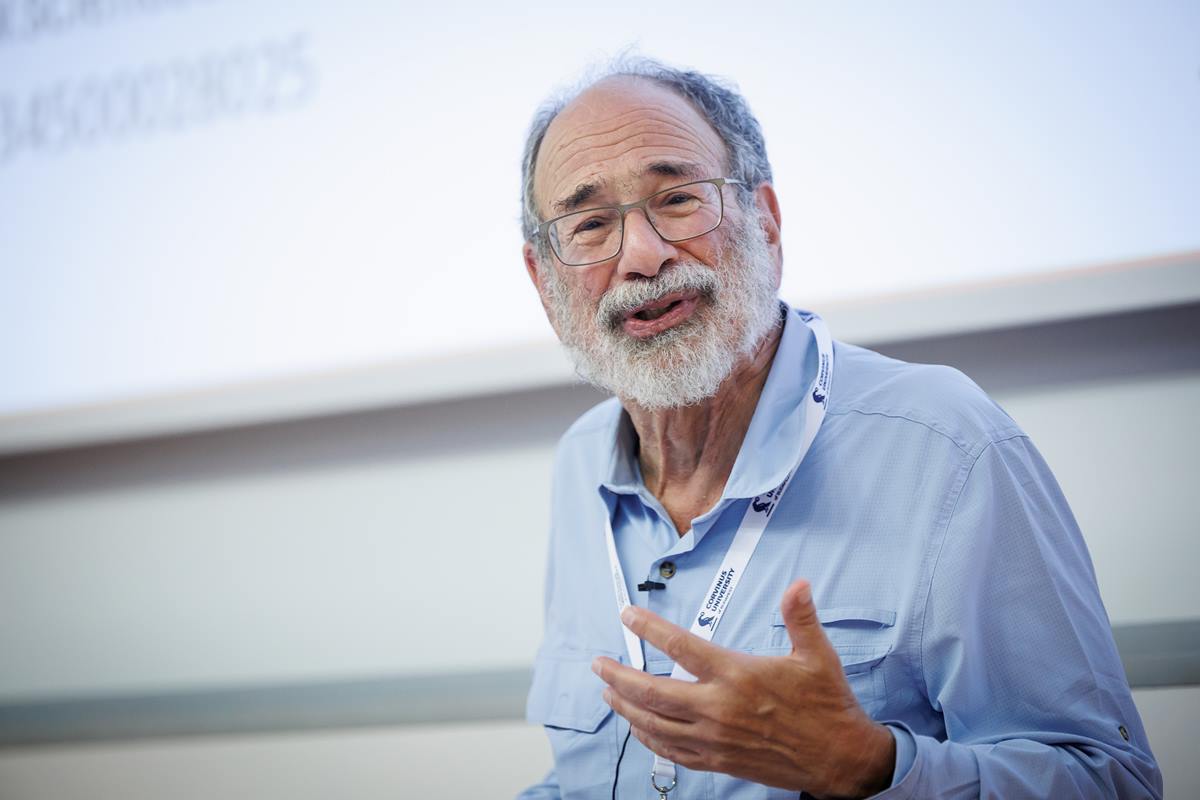

“Repugnance in human transactions became interesting to me” – interview with Alvin Roth

Alvin Roth, a pioneer American economist of market design and Nobel Prize winner of Economic Sciences, has been working lately with Corvinus researcher Bíró Péter on kidney exchange theories. The Stanford professor participated in the CMID-2024 conference at Corvinus in early July and told us, among other things, why his academic interest has recently turned to ethical issues in market design.

Alvin Roth interview

Your research has a lot of practical applications in our lives, like school applications or matching kidney donors and recipients. Are you driven as an economist by these questions by applying your theories to real life?

Alvin Roth: Well, economics is about real life. Economists are social scientists. We’re interested in how human beings coordinate with each other, cooperate, and compete. So even when we’re writing mathematical papers, we have at least in the back of our minds how it applies to the way people live their lives. And of course, market design is an engineering part of economics, we try to not just think about how we live our lives, but help build institutions that do what we want them to do.

The phenomenon of why human societies find certain transactions repugnant has long been a matter of scientific interest. In your lecture at the conference at Corvinus University, you examined two issues in more detail, randomized field experiments in the Econ job market, and kidney transplantation. Could you briefly summarize the results of your recent research on these two topics?

Alvin Roth: People usually have strong opinions based on little evidence about things they find repugnant. As an economist, I think that we should have good evidence when we make our decisions. And one way of that is to do experiments. But if you want to understand causality, you often need to have some randomness in your experiments. So it’s especially interesting to me that one of the things that sometimes people object to is randomizing treatments in experiments. There’s a natural feeling that it is unfair to treat some people one way and other people another way just because of randomization. In my opinion, experiments are one of the most useful tools for finding out why things happen. However, one reason we don’t see as many experiments as we should have is that people sometimes find experiments repugnant.

Transactions people find repugnant and express their moral or ethical concerns about, are very controversial. For instance, the European Parliament has just issued a statement that says they don’t think that donors of blood plasma should be paid. They think that countries should get all their blood plasma from unpaid donors. Now, Hungary is one of the places where blood plasma donors can be paid. And Hungary doesn’t have to import any blood plasma. They have enough domestically. But there are only five countries in the EU that have enough and they all pay plasma donors. The European countries that don’t pay plasma donors import plasma from the US, which exports plasma products because plasma donors can be paid in the US. So sometimes people’s feelings are contradictory. They would like that no one should be paid for plasma, but that there should be enough plasma. Those things don’t fit well together. And with kidneys, one of the big constraints we have is that it’s against the law just about everywhere in the world to pay a donor for a kidney. Corvinus researcher Bíró Peter is one of the leaders in working on kidney exchange theories about how you can get more transplants without paying donors.

Why has your academic interest recently turned to ethical issues in market design?

Alvin Roth: Sometimes the objections or the constraints on market designs are affected by ethical issues. For instance, we wouldn’t like a world where only rich people could get kidney transplants. When we talk about school choice, there have been questions in some of the cities about whether you can trade your priorities. So in most of the school districts I’ve worked with, if you want to put a child into a school and you already have a child who goes to that school, you get high priority. We tend to feel that parents should be able to drop their children off at school together. But some places allow people who don’t want their younger child to go to the same school as the older child to trade their priority to someone else. The question is, should we trade those? Some people thought that was like trading our children and you shouldn’t trade children. But we were able to convince them that it’s just about trying to find the right schools for children. So sometimes ethical intuitions can mislead us. We can do something better for the children by thinking through carefully and realizing that we’re not trading our children, we’re just trading their priorities.

You have been writing the blog Market Design since 2008, and since then you have written almost every day a post. What motivated you to start this blog and what role does it play in your professional life?

Alvin Roth: I started it for my class. I wanted the students to know that the way to think of ideas for market design is not just to read papers in economics journals but to read the newspaper and follow why markets weren’t working well. Many of my blog posts are short comments on a newspaper about something in the world. Since I started, it’s also proved to be a useful tool for me to remember things. So, it’s a kind of intellectual diary, as well. I’m currently working on a book on controversial markets and I look at my blog posts for each chapter. Market Design blog is my memory for everything related to market design.

read more:

- Diplomatic insights: Pakistan’s Ambassador discusses trade, education, and bilateral relations between Pakistan and Hungary – read the interview HERE

- Interview with Cynthia Mayer, Ambassador of Ecuador in Hungary on economic relations, Ecuadorian products in Hungary, politics, and more – read here

Hungarian economy minister highlights need to bolster SMEs

National Economy Minister Márton Nagy stressed the need to strengthen Hungarian-owned SMEs at an event organised by the Hungarian Chamber of Commerce and Industry (MKIK) on Monday, his ministry told MTI.

Hungarian economy minister talks about strengthening Hungarian-owned SMEs

In a presentation, National Economy Minster Márton Nagy said the value of cooperation and partnership had appreciated amid the crises faced by the global economy, adding that the MKIK was an important partner of the government that could signal businesses’ needs.

A strong business sector is a prerequisite for a strong economy and convergence, which is why every effort must be made to boost the competitiveness of SMEs, he said.

Acknowledging the impact of the war in Ukraine and weak external demand because of the faltering Germany economy, he said there was a need to be “more resilient and more creative” and called for a new economic policy. That policy requires thinking that is “4-5 steps ahead” and “targeted use of resources” concentrated on Hungarian-owned SMEs, he added.

He said a new state secretariat would be established soon within the National Economy Ministry dedicated to SMEs. He added that domestic demand, the source of much SME revenue, needed to be boosted, too.

The government will establish favourable financing conditions in the framework of a targeted action plan, while continuing to ensure interest support through the Széchenyi Card Programme, and launch a new capital scheme, the economy minister said.

SMEs also need a targeted programme offering investment subsidies based on one-off government decisions, like the scheme for big companies, he added.

The action plan being drafted places stress on SME digitalisation, without which staying competitive is “unimaginable”, he said. Every business needs their own website and an email, the economy minister added.

He said local businesses in commerce needed to start competing with foreign webshops as those were taking away a big chunk of Hungarians’ consumption.

Addressing wage policy, he said the minimum wage needed to be raised to 50pc of the average wage gradually. He added that businesses could manage that increase and it wouldn’t put SMEs at risk.

The Hungarian economy minister said the government was working on a package of measures targeting families with children, including bigger tax preferences and a new home purchase programme. He added that Hungarians needed to be given the option of saving a certain amount every year, tax free, to use for home purchases for themselves or their children.

He put next year’s GDP growth at 3-5pc and said the contribution of locally-owned SMEs to that expansion needed to increase.

Read also:

PM Orbán’s political director: ‘Hungary must represent a policy of economic neutrality’

Hungary has to endorse a policy of economic neutrality amid a transformation on a global level which is going with the emergence of economic blocs, the prime minister’s political director told public radio on Sunday.

PM’s political director talks about Hungary’s economic neutrality

Hungary must be on alert to respond with the appropriate strategy in the ongoing enormous global transformation, Balázs Orbán said on Kossuth radio.

He said that certain “western liberal players” aimed to respond to the transformation by limiting the scope of action of their allies in political, military, economic, cultural and other aspects “because they want to prevent them from maintaining ties with countries outside the alliance,” he said. “The emergence of such blocs in the western world would mean for Hungary to come under the control of a bloc, lose its sovereignty which would result in the country’s losing the opportunity to develop,” the political director said, adding that “this must be avoided by all means”.

“We do not want confrontation between the blocs, we reject the policy of the formation of blocs as we also reject the regime of sanctions and ideology or geopolitics driven trade relations,” he said, adding that such an approach “will take Hungary into a situation that allows a dynamic economic growth and development in the coming decades”.

The political director said that Hungary had to defend itself against “the social pressure mounted by the West with the aim to enforce upon us a liberal, universalist western culture in which nation, family, religious and social communities are no longer valued”.

He said Hungary’s modernisation had to continue, insisting that without well-developed infrastructure and industry branches, and advancements in education and talent support the country “will lag behind and will not be able to further strengthen”.

The political director called maintaining Hungary’s sovereignty and broadening the country’s foreign ties important tasks for the next several years.

The political director said that competition was enormous not only for Chinese but for other investments as well. “Hungary performs well in this competition because, among other things, it communicates openly, addresses other countries with respect, openly states what its interests are, what its opportunities are, while others cannot succeed as they want to give a kind of ideological or geopolitical guise to building trade relations, he said.

Balázs Orbán added that the policy that first made Hungary one of the most important trade partners for Germany and the German-speaking world must be maintained.

The Americans are still present in Hungary to a “significant extent”, cooperation is strong, there is hope this can be strengthened in the future, he said, adding and in recent years “an Asian leg has appeared” in the Hungarian economy. In addition to the Japanese, South Korean, Chinese and other investors have also appeared, while Hungarian companies have also found markets in Central Asia and the Far East, he added.

“These are all results that will show their everyday benefits in the coming years, when people will notice that Hungarian wages are rising, Hungarian jobs are protected, and the Hungarian supply chain is becoming stronger and stronger.”

Talking about the Russian-Ukraine war, he said that according to books, these types of military conflicts are always resolved by restoring communication channels and establishing short-term ceasefires, these create an international environment where there is a chance to reach a long-term solution.

Asked whether the European elite’s attitude towards Hungary would change, the political director said that “the liberals have serious positions in the European political leadership, and we are working against the wind,” but “in European politics in this situation too, there must be an allied policy and strategy on how to enforce their own interests”.

Orban said there had been progress made on this issue in the past months as the Patriots for Europe (PoE) European parliamentary group had been established. “Also, Hungary is now holding the rotating EU presidency and these are serious opportunities that must be tapped.”

Read also:

Exciting: Direct bus to connect the Hungarian capital with Designer Outlet in Parndorf, Austria

We are fairly certain that there is no need to introduce the hugely popular Designer Outlet in Parndorf, Austria, to anyone who loves shopping. Here, you can find your favourite designer pieces at significant discounts. From 20 September, a direct bus service will connect Budapest with the Parndorf outlet.

Designer Outlet in Parndorf is popular among Hungarians

As Telex writes, the Designer Outlet in Parndorf, a well-known shopping destination for Hungarians, attracts around one-sixth of its visitors from Hungary each year. Opened in 1998 and located in Burgenland, Austria, the outlet is a major employer in the region, with 48% of its 2,000 staff coming from Hungary or Slovakia, and three-quarters of its workforce being women. Managed by McArthurGlen, the Designer Outlet in Parndorf features 160 designer brands spread over 37,000 square metres and is currently undergoing expansion. Despite its popularity, the company plans to strengthen its engagement with Hungarian media in the future.

Covid’s effects are wearing off

The manager of the Designer Outlet in Parndorf told *Telex* that despite the arrival of well-known brands in neighbouring countries and the impact of Covid, the proportion of Hungarian visitors, at 15-18%, has remained stable. This suggests that as the outlet grows, interest from Hungarian shoppers increases in line with overall visitor numbers. Before Covid, Parndorf saw a peak of 6.2 million visitors in 2019, followed by a decline. However, in 2023, the Designer Outlet in Parndorf achieved a record-breaking 6.8 million visitors.

What’s behind the outlet’s success?

McArthurGlen, Europe’s leading designer outlet operator, manages 24 outlets across eight countries, including the Designer Outlet in Parndorf, which is its easternmost location. With an annual turnover of EUR 5 billion, McArthurGlen has a strong presence in Western Europe and even Canada. What sets the Designer Outlet in Parndorf apart is its proximity to three capitals—Vienna, Budapest, and Bratislava—all within a 90-minute drive. While some outlets serve larger populations within this range, Parndorf’s unique location adds to its appeal.

The number of Hungarian shoppers at the Designer Outlet in Parndorf grew by 27% last year and by 12% in the first half of this year. While the exact spending by Hungarians has not been disclosed, it was noted that Middle Eastern and Asian shoppers, who often seek luxury goods, tend to spend more per visit. To attract more Hungarian visitors, the company is introducing shuttle buses from Budapest. However, Parndorf is also accessible by rail and is located near hotels and entertainment venues.

Exciting new developments ahead!

From 20 September, the Designer Outlet in Parndorf will launch a direct shuttle bus service from Budapest. The 20-seater bus will depart from Báthory Street at 9 am, with tickets priced at EUR 29. Shoppers will have around five hours to explore the outlet, with the return bus leaving at 4:30 pm and arriving back in Budapest by early evening. Parndorf is also expanding its offerings, with popular overnight shopping events and new luxury brands like Alexander McQueen joining in September, alongside Spyder, Red Bull World, and Tommy Hilfiger Kids.

Read also:

Hungarian economy struggles: latest figures reveal significant downturn

The Hungarian Central Statistical Office (KSH) has detailed how the GDP data for April-June were compiled, confirming the worst expectations in the Hungarian economy.

The KSH confirmed in a second reading of data on Tuesday that Hungary’s GDP rose 1.5 percent year over year in the second quarter.

Adjusted for calendar year effects, GDP rose 1.3pc.

In a quarter-on-quarter comparison, GDP edged down 0.2pc, adjusted for seasonal and calendar year effects.

On the production side, headline GDP was lifted by 1.4pp from services, 0.4pp from the balance of taxes and subsidies on products, and 0.3pp from the construction sector. The farm sector reduced economic performance by 0.2pp and industry by 0.5pp.

On the expenditure side, the trade balance contributed 1.0pp to GDP growth and final consumption 1.9pp. Gross capital formation had a 1.4pp negative impact on GDP.

The Central Statistical Office (KSH) said in a second reading of data on Monday that the value of exports in euro fell by 9.9% compared with a year earlier, read details HERE.

- read also: Hungarian government plans significant minimum wage increase – Could EUR 1,000 become the new standard?

Hungarian economy shows disappointing latest data

Hungary’s trade balance in June posted a surplus of 1.1 billion euros, deteriorating by 411 million euros from the previous year.

KSH said exports dropped by an annual 9.9 percent to 12.3 billion euros, while imports slipped by 7.8 percent to 11.1 billion euros.

In volume terms, exports fell by an annual 8.1 percent, and imports by 5.2 percent.

Month on month, export volume was down a seasonally and working-day adjusted 2.4 percent, while imports were up 4.7 percent.

Compared to a year earlier:

According to calendar-adjusted data, the volume of export decreased by 1.4%, that of import improved by 1.3%.

The balance of the external trade in goods deteriorated by EUR 411 million. (The balance showed a EUR 28 million higher surplus than the one published in the first estimate.)

The HUF price level of the external trade in goods increased by 4.3% in exports and by 3.5% in imports, compared to the same month of the previous year. The terms of trade improved by 0.8%. The HUF exchange rate depreciated by 6.4% against the EUR and by 7.2% against the US dollar.

The export volume of machinery and transport equipment decreased by 15%, their import declined by 8.4%. Both the export and import volume of the commodity group of electrical machinery, apparatus and appliances, n.e.s. decreased sharply. The export volume of the commodity group of road vehicles declined by nearly one-tenth, its import volume fell by nearly one-fifth compared to the base period. The export volume of the commodity group telecommunication and sound recording and reproducing apparatus decreased by more than one-tenth, while its import volume rose by nearly one-tenth, year-on-year. The turnover of the power generating machinery and equipment commodity group decreased in both trade directions equally by nearly one-fifth compared to the same period of the previous year’s level. The aggregate commodity group of machinery and transport equipment contributed to the overall volume decrease in total turnover by 9.0 percentage points on the export side and by 3.9 percentage points on the import one.

The export volume of manufactured goods became 1.7% lower, while their import volume decreased by 4.2%. The volume lesseningwas driven by professional, scientific and controlling instruments and apparatus, n.e.s. on the export side, and by chemical materials and products, n.e.s. on the import one. The aggregate commodity group of manufactured goods intensified the overall volume decrease in export by 0.5 percentage points, and in import by 1.6 percentage points.

The export volume of fuels and electric energy increased by 44%, their import volume was 5.3% higher than one year earlier. The turnover growth in both export and import can be explained by the significant increase in the volume of electrical energy. The turnover growth in fuels and electric energy counterbalancedthe decrease of the overall export volume by 1.0 percentage point, and by 0.4 percentage points the import one.

The export volume of food, beverages and tobacco became 8.2% higher, their import volume decreased by 4.0%. The volume growth was driven by cereals and cereal preparations on the export side, and by fruit and vegetables in the decrease on the import one. The volume change realised by the aggregate commodity group slowed the total export decrease by 0.5 percentage points, and contributed to the import decrease by 0.2 percentage points.

The volume of export to the EU-27 Member States became 10% lower and that of import from there decreased by 4.0%. The balance of the external trade in goods declined by EUR 685 million, generating a surplus of EUR 1.3 billion. This group of countries accounted for 76% of exports and 72% of imports.

In the extra-EU-27 trade, the volume of export decreased by 0.2%, that of import declined by 8.3%. The balance of the external trade in goods with these countries improved by EUR 274 million, showing a deficit of EUR 143 million.

Hungarian economy in January–June 2024:

The value of exports amounted to EUR 73.3 billion (HUF 28.6 thousand billion), that of imports to EUR 65.6 billion (HUF 25.6 thousand billion).

In January–June 2024 compared to one year earlier, the volume of export decreased by 2.2%, that of import lessened by 6.4%. The balance of the external trade in goods improved by EUR 3.7 billion, the surplus was EUR 7.8 billion. The HUF price level of the external trade in goods lessened by 1.1% on the export side, and by 2.6% on the import one, compared to the same period of the previous year. The terms of trade improved by 1.5%. The HUF depreciated equally against the EUR and the US dollar, by 2.3%.

read also:

- Europe’s biggest online webshop enters Hungary this year

- Spain blocks Hungarian Talgo train factory deal over Orbán’s Russia ties, details HERE

Hungarian forint’s low value uncovered: Big Mac Index highlights price disparities

According to the latest Big Mac Index from The Economist, Switzerland and Norway remain the most expensive countries in the world. In these two European nations, a Big Mac costs EUR 6.71 and 6.26, respectively. In contrast, Hungary ranks at the bottom of the list, with an average price of just EUR 2.65 for the same sandwich.

The Big Mac Index

The Big Mac Index was introduced by The Economist in 1986 as a quirky way to measure purchasing power parity across countries. Since then, it has become a widely recognised global economic indicator, Pénzcentrum writes. The index compares the price of Big Macs in different countries to the price in the United States, offering insights into economic conditions and serving as a practical tool for gauging consumer purchasing power worldwide.

In the United States, a Big Mac typically costs around EUR 5.15, though prices vary by region. Of the 78 countries included in the index, only five—Switzerland, Norway, Uruguay, Sweden, and Canada—have local average prices higher than those in the U.S.

Switzerland tops the list with a price of EUR 6.71, which is about 30.3% higher than the U.S. average.

This substantial difference is driven by factors like higher labour costs, different purchasing power, and taxes. Following Switzerland are Norway, Uruguay, Sweden, and Canada, each with varying degrees of price differences.

On the other hand, countries like Lebanon, Israel, and the United Arab Emirates have slightly lower Big Mac prices compared to the U.S. In Lebanon, for instance, a Big Mac costs EUR 5.08. In several European countries, such as Andorra, Austria, and Belgium, Big Mac prices are about 7.47% lower than in the U.S.

At the bottom of the list, the ten countries with the lowest Big Mac Index include Turkey, Hungary, Taiwan, Malaysia, Egypt, India, Indonesia, South Africa, Romania, and Venezuela. In Venezuela, a Big Mac costs just EUR 1.76, reflecting the country’s ongoing hyperinflation and currency devaluation. These significant price disparities highlight the varying economic conditions across the globe.

Undervalued and overvalued currencies

The index also reveals the extent to which national currencies are either undervalued or overvalued relative to the U.S. dollar. The Uruguayan peso, for instance, is overvalued by 51.8%, while Taiwan’s dollar is undervalued by 59.3%. Overvaluation means that, based on the per capita GDP differences, a Big Mac should cost less in a particular country than in the U.S., but it ends up being more expensive. Undervaluation is the opposite.

According to The Economist’s latest rankings, other significantly overvalued currencies include the Argentine peso (47%), the Swiss franc (45.6%), the Norwegian krone (22.5%), and the Costa Rican colón (20.6%). In the eurozone, the euro is overvalued by 19.7% compared to the U.S. dollar, while the British pound is overvalued by 14%.

In stark contrast, the Hungarian forint is undervalued by a significant 20.3%, as indicated by the Big Mac Index.

Read also:

- Hungarian government plans significant minimum wage increase – Could EUR 1,000 become the new standard?

- Real wages fell brutally: Big Mac index plummeting in Hungary

Featured image: depositphotos.com

Hungarian government plans significant minimum wage increase – Could EUR 1,000 become the new standard?

By 2027, the Orbán government intends to raise Hungary’s minimum wage to 50% of the average wage. According to analysis, this ambition would require a significant rise in the minimum wage over the next three years.

Portfolio has analysed the government’s plans regarding the future of the minimum wage and outlined the steps necessary to achieve this goal. It argues that meeting the 2027 target would demand a sharp increase in the minimum wage over the coming years, while average wage growth would need to be considerably more moderate.

Ambitious government plans for 2027

Over the past decade, Hungary’s minimum wage has remained relatively stable at around 40% of the average wage. Despite periodic economic fluctuations, there has been no consistent, rapid increase in the minimum wage relative to the average. However, the Orbán government now appears committed to a more sustained upward trajectory, according to Portfolio, citing statements from Gergely Gulyás, the Head of the Prime Minister’s Office, and Márton Nagy, the Minister for National Economy.

Photo: MTI/Soós Lajos

Gulyás posited on Thursday that a swift and significant rise in the minimum wage would benefit the country. He noted that such a change would involve dialogue between employers and employees, with the government acting as a mediator. Ideally, Gulyás envisions a three-year agreement between the parties, which could lead to a convergence of wages for both degree and non-degree holders, while also bringing the median wage closer to the average.

In a separate statement the day before, Nagy remarked that “it is essential to raise the minimum wage to 50% of the average wage, albeit gradually, but by 2027 at the latest.”

The need for a rapid wage increase

The government’s proposal implies a significant annual rise in the minimum wage. Assuming stable annual wage growth in the coming years, the average salary is expected to reach around HUF 860,000 (EUR 2,183) gross by 2027. This would necessitate a minimum wage of HUF 430,000 (EUR 1,091) to fulfil the government’s 50% target.

For context, the current minimum wage in Hungary is HUF 266,800 (EUR 677). Achieving the HUF 430,000 target would require annual increases of around 17-18%, while average wage growth would need to be limited to no more than 10% per annum. Overall, the minimum wage would need to rise by roughly 60% over the next three years.

However, even this rate of growth is not without its challenges, Portfolio warns. A substantial increase in the minimum wage could lead to upward pressure on other wage categories to prevent wage displacement. Additionally, with the country facing increasing labour shortages, wage demands across various sectors are likely to rise, potentially resulting in further wage inflation.

Bold plans, but rapid growth brings risks

While such a rapid rise in the minimum wage is feasible, sustaining it over time is crucial to ensure the convergence is not temporary. Even after 2027, the minimum wage would need to continue growing at least as quickly as the national average wage to maintain parity.

Moreover, such a sharp rise in minimum wages carries risks for the Hungarian economy. Smaller businesses, in particular, could struggle to afford the sudden increase in wage bills. Some economists argue that labour shortages could help alleviate this issue; if less efficient firms fail, workers may more easily find employment elsewhere, potentially boosting overall economic efficiency.

However, rapid wage increases can drive up consumer prices, leading to inflation. To cover the rising wage costs, businesses raise their prices, which in turn prompts workers to demand higher wages. This issue can become particularly problematic if increases in the minimum wage remain substantial, as planned, over several years. Such a scenario could trigger a price-wage spiral, causing both the minimum and average wages to rise rapidly. Consequently, those earning within either wage bracket may see little real benefit from the changes in practice.

Read also:

- Orbán cabinet promises wage hike amidst labour shortage crisis in Hungary’s education – UPDATED

- Hungary preceding Romania, Slovakia, Czechia etc. in this wage type, says ministry

Forint in trouble – EUR/HUF is close to 400 again

The forint has been on a steady decline against the euro and might continue its trajectory due to foreign trade flow setbacks in the coming months. The last time the forint fell so spectacularly against the common EU currency was in the spring of this year. Meanwhile, international markets are cautious, worsening the dollar exchange rate.

The forint continues to depreciate against the euro

Telex reports that the euro reached HUF 398.4 at dawn on Monday, and the situation had not improved significantly by the early hours of the day. Throughout the morning, the euro was trading steadily around HUF 398-399, and after 9 a.m., it crossed the HUF 399 mark. The Hungarian currency started the week badly, but its current deterioration did not come out of nowhere.

As Telex pointed out in a previous article, there has been a continuous deprecation in the EUR/HUF exchange rate in recent days. On 30 July, the forint reached a multi-week low against the euro, with the price of one euro hovering between HUF 392 and 395. The last time the forint performed this poorly against the euro was in March of this year.

An interesting point of comparison is that the USD/HUF exchange rate has not seen a similar fall, with Monday’s level of HUF 364 even an improvement on the price four days ago. This is due to the fact that, as Portfolio writes, international markets remain highly pessimistic, with recession fears in the US increasing significantly in recent days. This has caused a sharp weakening of the US dollar.

Macroeconomic data brings bad news for the forint

Meanwhile, Portfolio also reports that the latest Hungarian macroeconomic data do not paint an encouraging picture for the forint. Citing the analysis of Gábor Regős, Chief Economist at Granit Fund Management, the site writes that although the Hungarian trade surplus is significant, it has seen significant setbacks, and the decline in the value of foreign trade could have a negative impact on the forint.

As Portfolio points out, both export and import volumes fell by roughly 10 and 7 percent respectively, in June. According to Gábor Regős, the fall in exports can be explained by low external demand, “which is dragging down the performance of vehicle and battery production in particular – although this also means that the transition to electric cars is progressing more slowly than expected, but German industry is suffering from the opposite, low demand for conventional cars, which means the problem of vehicle production in general.” The decline in imports is mainly explained by low investment volumes.

Overall, Regő puts Hungary’s trade balance at roughly EUR 1.1 billion, which he says is “not low, but significantly below a year ago.” Presumably, a drop in export volumes could also be behind the Hungarian GDP decline in the second quarter of the year.

Besides the trade balance, these figures could have implications for the future of the forint, as well. As Gábor Regős writes: “This is a mixed situation for the forint: while the current account surplus is likely to remain, which supports the exchange rate, unfavourable exports and thus expected weak industrial data also spell bad news for the forint.”

At a point where the EUR/HUF exchange rate is already close to crossing the 400 threshold, and the forint has experienced multiple setbacks in the span of a few weeks, slowing exports and a stumbling industry may be, as Regős puts it, “particularly dangerous” for the future of the Hungarian currency.

Read also: